WTI Crude - Still Holding Up

rhboskres

Publish date: Thu, 30 Jul 2020, 06:45 PM

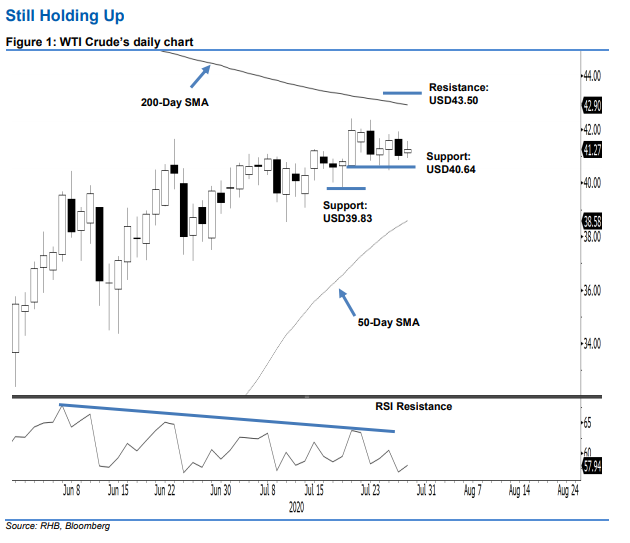

Maintain long positions. The WTI Crude continued to trade in a relatively narrow trading range during the latest session, a phenomena that has been developing over the past three weeks or so. After hitting a low and high of USD40.93 and USD41.57, the commodity settled USD0.23 higher at USD41.27. The RSI, which is not showing signs of picking up, indicates that momentum is not strong. Even so, in the absence of price reversal signals, the thesis that the rebound is still in place, remains. We maintain our positive trading bias.

We advise traders to stay in long positions, which we initiated at USD41.96 – the closing level of 21 Jul. To manage risks, a stop-loss can be placed below the USD39.83 mark.

We are keeping the immediate support at USD40.64 – the low of 21 Jul. This is followed by USD39.83, or the low of 20 Jul. Towards the upside, the immediate resistance is set at USD43.50, followed by USD45.00.

Source: RHB Securities Research - 30 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024