COMEX Gold - Overbought But No Price Exhaustion

rhboskres

Publish date: Thu, 30 Jul 2020, 06:46 PM

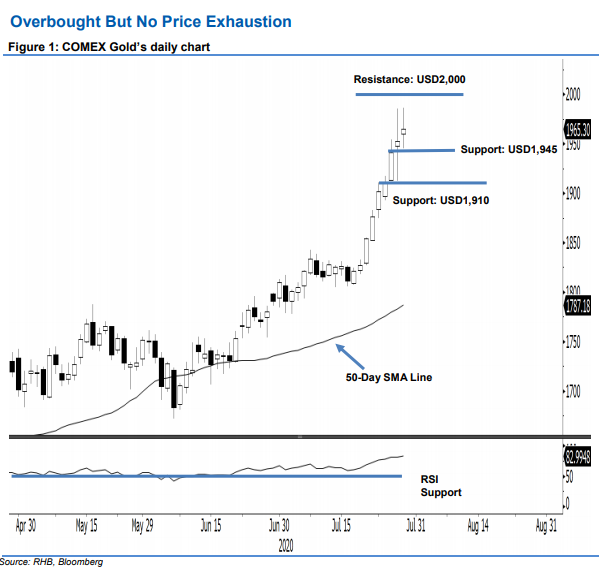

Music is still playing; maintain long positions. After a sharp swing during the prior session, COMEX Gold ended the latest session USD12.50 stronger, at USD1,965.30. At one point, it reached a high of USD1,986.40. The two most recent sessions’ price performance indicates that the commodity’s upward move is still firmly in place – no price exhaustion signals have been spotted. This is despite the recent price surge ,which turned unhealthy with the RSI flashing out overbought signals. We maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD1,766.40, which was the closing level of 22 Jun. For risk-management purposes, a stop-loss can now be placed below USD1,900.00

We revise the immediate support to USD1,945, near the latest low. This is followed by USD1,910 – slightly below 28 Jul’s low. Moving up, immediate resistance is now pegged at the USD2,000 round figure, followed by USD2,050.

Source: RHB Securities Research - 30 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024