FKLI- No Reversal Signal

rhboskres

Publish date: Mon, 03 Aug 2020, 01:06 AM

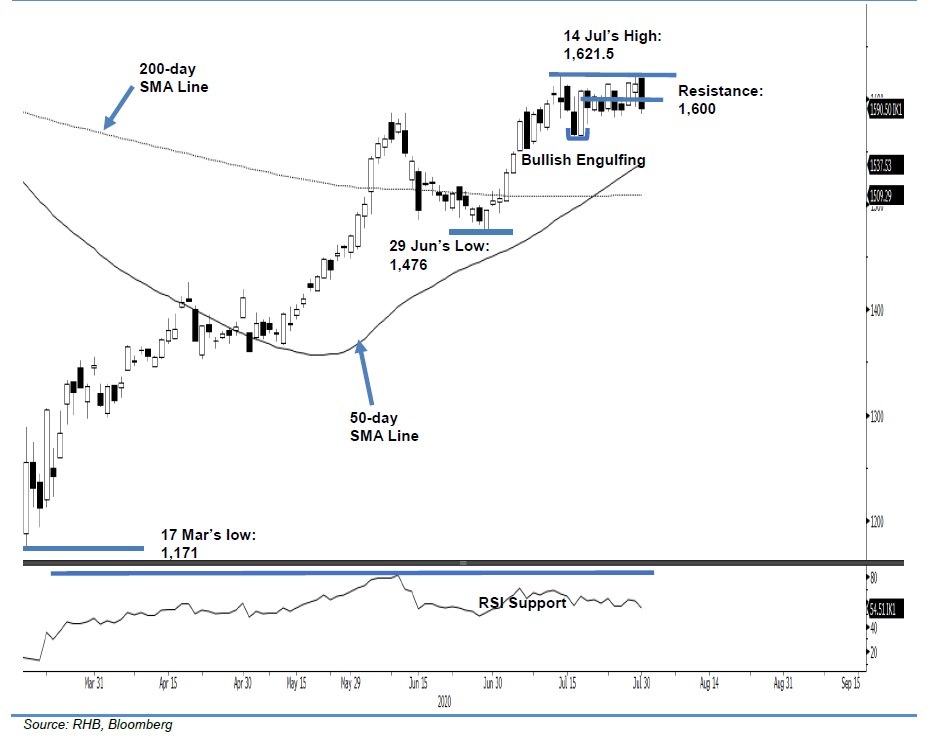

No sign of a trend reversal; maintain long positions. The FKLI traded between 1,585 pts and 1,619.5 pts last Thursday, before closing 23.5 pts weaker at 1,590.5 pts –below the 1,600-pt mark. The negative session came after it failed to cross above 1,621.5 pts in a prior session. Despite this negative development, from the trend perspective, this is not enough to indicate that the index’s uptrend is due for a retracement. As such, we are maintaining a positive trading bias.

Until further negative price actions take place in the coming sessions – which would confirm a trend reversal – we recommend that traders remain in long positions. We initiated these at 1,607 pts, the closing level of 17 Jul. To manage risks, we revise our stop-loss to under 1,580 pts.

The immediate support is revised to 1,580 pts, followed by 1,564 pts – the low of 17 Jul’s “Bullish Engulfing” formation. Meanwhile, the immediate resistance is now at 1,600 pts, followed by 1,615 pts.

Source: RHB Securities Research - 11 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024