FKLI- Retracement Leg May Be Developing

rhboskres

Publish date: Tue, 04 Aug 2020, 01:11 AM

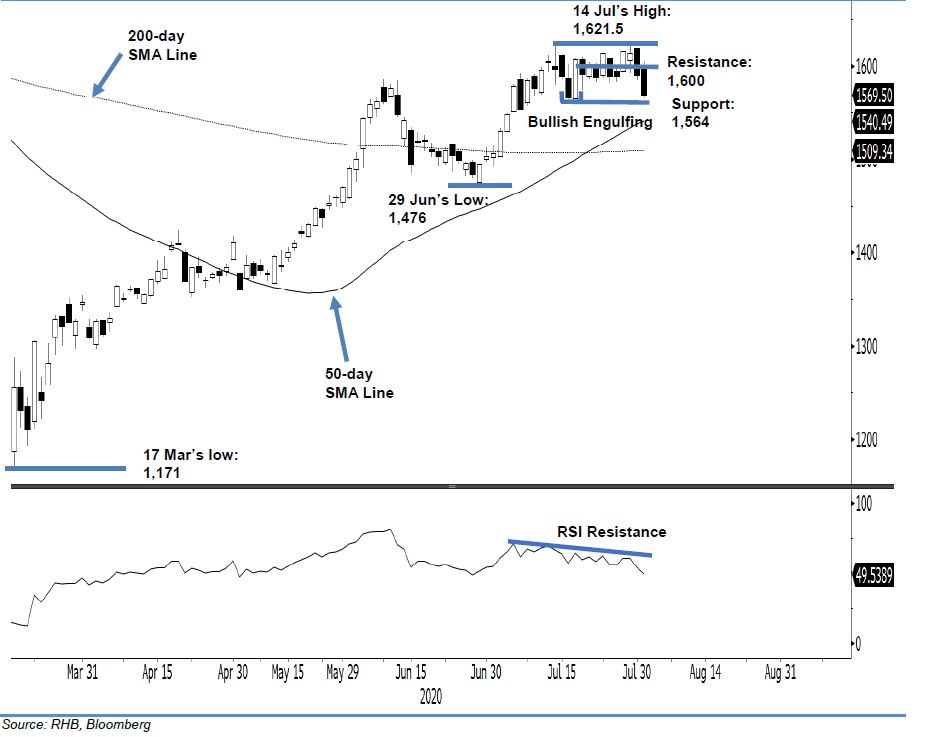

Initiate short positions, as a deeper correction phase may be taking place. The FKLI closed on a soft note again for the third consecutive session yesterday, following a failed attempt to cross above 1,621.5 pts on 29 Jul. It shed 29 pts to close at 1,569.5 pts, breaching the previous immediate support of 1,580 pts and falling further below the 1,600-pt mark. In our view, this weak performance confirms a price rejection from the 1,621.5-pt level. This implies that the risk of a deeper correction phase kicking in, is high. Premised on this, we switch our trading bias from positive.

Our previous long positions, initiated at 1,607 pts – the closing level of 17 Jul – were closed out at 1,580 pts yesterday. Concurrently, we initiate short positions at the latest closing. To manage risks, a stop-loss can be placed above 1,615 pts.

The immediate support is revised to 1,564 pts – the low of 17 Jul’s “Bullish Engulfing” formation. This is followed by 1,550 pts – near the low of 6 Jul. Towards the upside, the immediate resistance is now at 1,580 pts, followed by 1,600 pts.

Source: RHB Securities Research - 4 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024