E-Mini Dow- Bouncing Off From the SMA Lines

rhboskres

Publish date: Wed, 05 Aug 2020, 12:58 AM

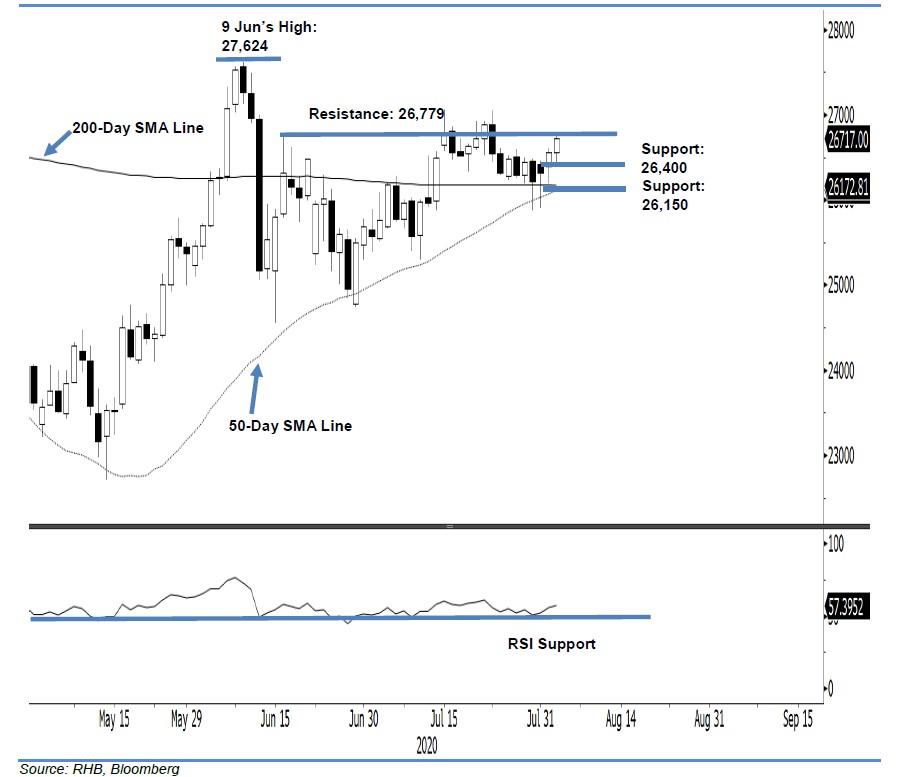

Maintain long positions. The E-mini Dow is showing good signs of extending its upward move, following the retesting of the 50- and 200-day SMA lines on 30-31 Jul. At the close, the index settled 159 pts higher at 26,717 pts – coming close to testing the 26,779-pt immediate resistance. Additionally, the RSI reading is also showing signs of reversing, indicating that momentum is picking up. We maintain our positive trading bias.

We advise traders to stay in long positions. For risk-management purposes, a stop-loss is recommended below the 26,150-pt mark.

We revise the immediate support to 26,400 pts, ie the price point of the latest session. This is followed by 26,150 pts, which is near the 200-day SMA line. Towards the upside, the immediate resistance level is maintained at 26,779 pts, or the high of 16 Jun. This is followed by the 27,000-pt round figure.

Source: RHB Securities Research - 5 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024