FCPO - Downside Risk Still High

rhboskres

Publish date: Thu, 06 Aug 2020, 06:20 PM

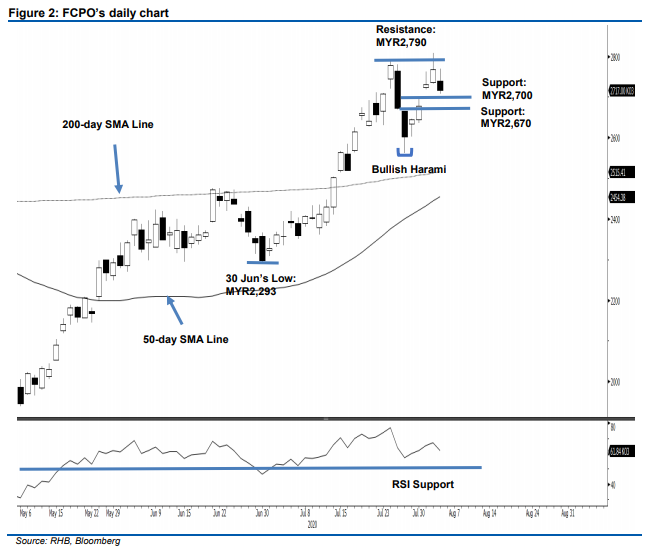

Maintain short positions. The FCPO ended its 4-day winning streak in the latest session to settle MYR51 lower at MYR2,717 as it failed to breach the MYR2,790 resistance point in the prior session. Broadly, we believe the commodity’s next big move is tilted towards the downside. This retracement is meant to correct the commodity’s upward move that took place from the low in May till 4 Aug. Hence, we are keeping our negative trading bias.

We advise traders to stay in short positions. We initiated these at MYR2,672, the closing level of 27 Jul. To manage risks, a stop-loss can now be set above MYR2,790.

We revised the immediate support MYR2,700 round figure. This is followed by MYR2,670 – derived from 30 Jul’s candle. Meanwhile, we revised the immediate resistance to MYR2,760, price point of the latest session. This is followed by MYR2,790, derived from 24 Jul’s high.

Source: RHB Securities Research - 6 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024