FCPO - Negatieve Bias Stays

rhboskres

Publish date: Mon, 10 Aug 2020, 12:20 PM

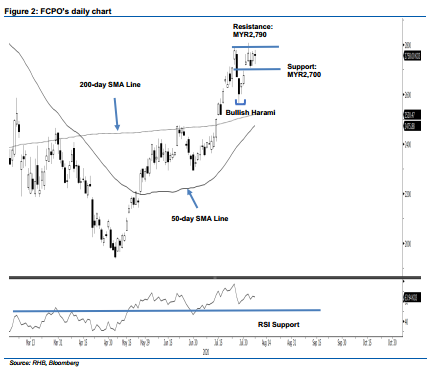

Maintain short positions. The FCPO rebounded from an intraday low of MYR2,722 to narrow its losses to MYR7 to close at MYR2,758. While the commodity has been holding above the MYR2,700 support mark over the past three sessions, provided prices are still capped at below the MYR2,790 resistance point, the downside risk would remain high. We believe a correction phase is in the process of developing to correct the previous multi-week upward move. Maintain our negative trading bias.

We advise traders to stay in short positions. We initiated these at MYR2,672, the closing level of 27 Jul. To manage risks, a stop-loss can now be set above MYR2,790.

Immediate support is pegged at MYR2,730 – the price point of 6 Aug. This is followed by MYR2,700. Towards the upside, the immediate resistance is set at MYR2,790, derived from 24 Jul’s high. This is followed by MYR2,808, the high of 4 Aug

Source: RHB Securities Research - 10 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024