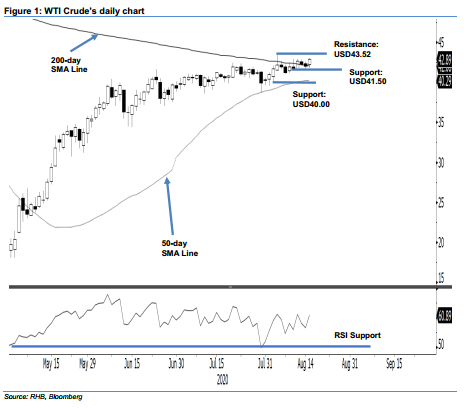

WTI Crude - Consolidating Around The 200-Day SMA

rhboskres

Publish date: Tue, 18 Aug 2020, 04:01 PM

Maintain long positions. The WTI Crude ended the latest session USD0.88 higher at USD42.89, after testing the USD42.95 threshold with a high of USD42.97. Price actions over the past two weeks indicate that the commodity is developing a relatively narrow sideways consolidation around the 200-day SMA line. This indicates that the bulls are still controlling the trend. Based on the recent sessions’ price actions, this positive bias should stay, provided that the USD41.50 support is not breached.

We advise traders to stay in long positions, which we initiated at the USD41.96 mark, or the closing level of 21 Jul. To manage risks, a stop-loss can now be placed below the USD41.50 mark.

The immediate support is maintained at USD41.50, which is near the lows of 11 and 12 Aug. This is followed by the USD40.00 round figure. Meanwhile, the immediate resistance is pegged at USD42.95, near the highs of 11 and 12 Aug. This is followed by USD43.52, which was derived from 5 Aug’s hig

Source: RHB Securities Research - 18 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024