Hang Seng Index Futures - Technical Picture Stays Positive

rhboskres

Publish date: Wed, 19 Aug 2020, 03:08 PM

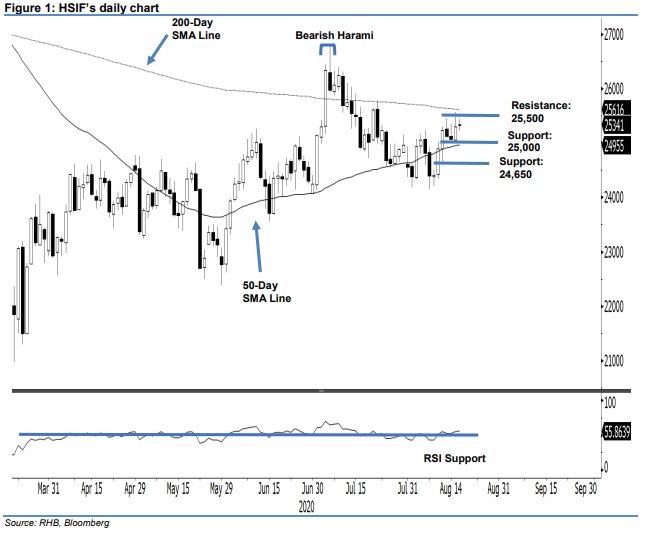

Maintain long positions. The HSIF traded in a relatively narrow range of 25,213 – 25,440 pts before ending 48 pts higher at 25,341 pts. Based on the index’s price actions over the past few sessions, it is showing signs of developing a sideways trading range between 25,000 – 25,600 pts, which is a zone between the 50-day and 200-day SMA lines. This is a healthy consolidation process, following the index’s prior multi-session upward move. We maintain our positive trading bias.

We advise traders to stay in long positions, which we initiated at 25,235 pts, i.e the closing level of 12 Aug. For riskmanagement purposes, a stop-loss can be now placed below the 24,650-pt mark.

Immediate support is maintained at the 25,000-pt round figure, followed by 24,650 pts – near 12 Aug’s low. Conversely, the immediate resistance is set at 25,500 pts and followed by 25,650 pts, which is a level near the 200-day SMA line.

Source: RHB Securities Research - 19 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024