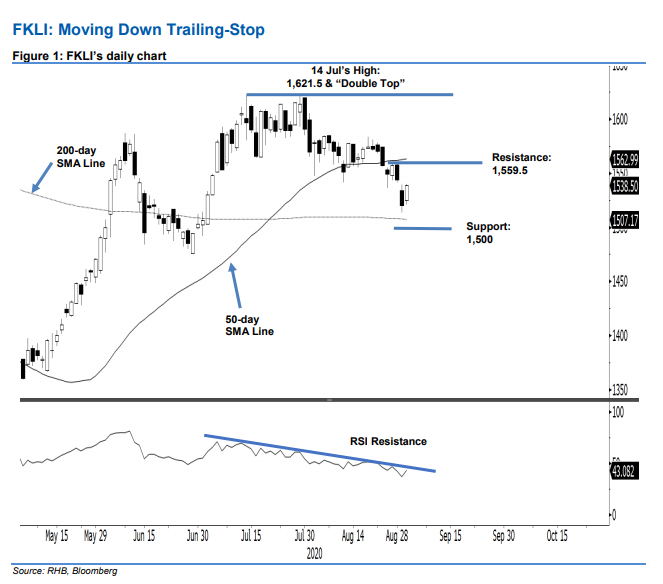

FKLI - Moving Down Trailing - Stop

rhboskres

Publish date: Thu, 03 Sep 2020, 06:31 PM

Maintain short positions. The FKLI settled the latest session 18 pts higher, at 1,538.5 pts. The positive performance came after the index underwent a price rejection from the 50-day SMA line in the prior two session. It also came close to testing the 200-day SMA line in yesterday’s session. As such, the latest session can be regarded as a sign that the bulls are trying to end the index’s retracement phase, which started following the emergence of the “Double-Top” formation in end-July. Until further positive price actions emerge, we are maintaining a negative trading bias.

Traders should remain in short positions. We initiated these at 1,569.5 pts, the closing level of 3 Aug. To manage risks, a stop-loss can now be placed above 1,559.5 pts.

The immediate support is revised to 1,520 pts – the price point of 1 Sep. This is followed by 1,500 pts. Moving up, the resistance points are maintained at 1,540 pts and 1,559.5 pts – the high of 27 Aug

Source: RHB Securities Research - 3 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024