FCPO: Uptrend Remains Sturdy

rhboskres

Publish date: Thu, 03 Sep 2020, 06:33 PM

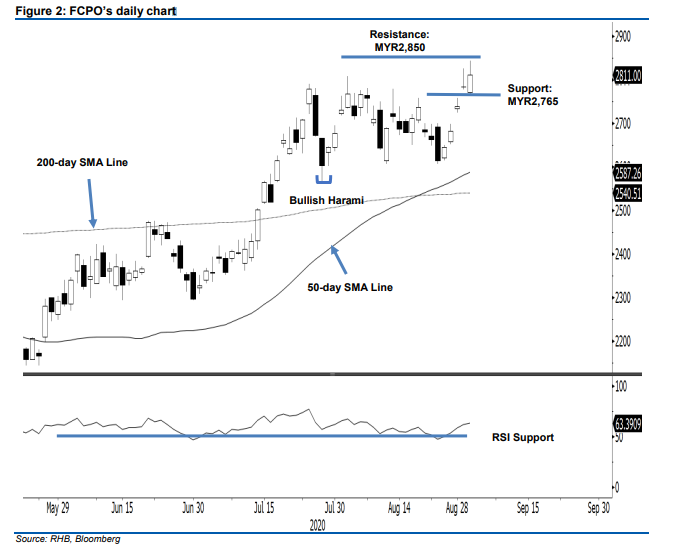

No price exhaustion signal; maintain long positions. The FCPO underwent a reversal from the session’s low of MYR2,765 to end MYR27.00 higher at MYR2,811, thereby crossing above the previous immediate resistance of MYR2,800. The positive performance invalidated the prior session’s “Doji” formation, which appeared following the commodity’s recent strong upward move. Additionally, the closing level also placed the commodity slightly above the prior sideways trading range of MYR2,600-2,800. Premised on this, we maintain a positive trading bias.

Until signs of this trend being exhausted appear, we advise traders to stay in long positions. We initiated these at MYR2,738, the closing level of 28 Aug. To manage risks, a stop-loss can be now be placed below MYR2,765.

The immediate support is revised to MYR2,765, the latest low. This is followed by MYR2,725. Conversely, the immediate resistance is now pegged at MYR2,850, followed by MYR2,895 – the high of 6 Feb.

Source: RHB Securities Research - 3 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024