FCPO - Possilble Profit Taking

rhboskres

Publish date: Mon, 07 Sep 2020, 12:20 PM

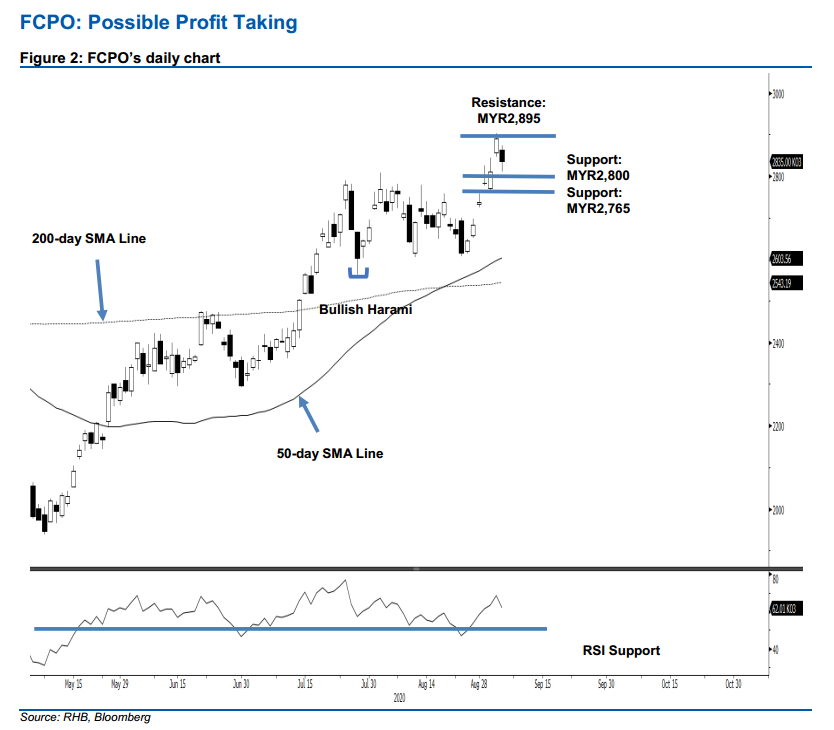

Maintain long positions. Last Friday, the FCPO ended its positive run after six consecutive sessions, falling MYR56 to MYR2,835 – this came after it reached a low of MYR2,811. With prices staying above the previous sideways trading range of MYR2,600-MYR2,800, the risk of a deeper correction remains contained at this juncture – the latest weak performance is possibly due to profit taking activities. This bias would stay provided the MYR2,800 support level is not breached. Maintaining our positive trading bias.

We advise traders to stay in long positions. We initiated these at MYR2,738, the closing level of 28 Aug. To manage risks, a stop-loss can be now be placed below MYR2,800.

The immediate support is revised to MYR2,800 round figure followed by MYR2,765, which is the low of 2 Sep. Conversely, the immediate resistance is set at MYR2,855, followed by MYR2,895 – the high of 6 Feb.

Source: RHB Securities Research - 7 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024