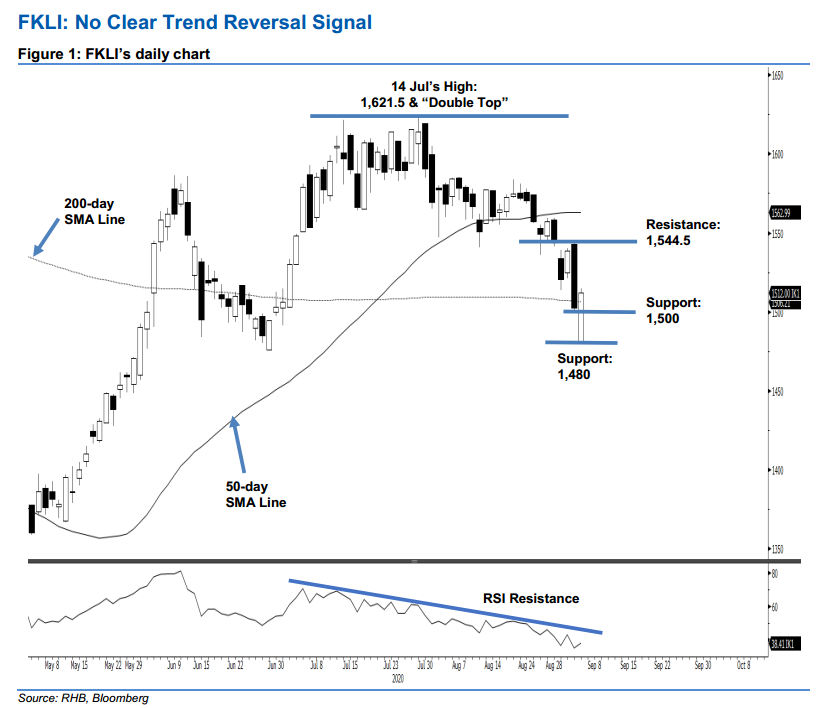

FKLI - No Clear Trend Reversal Signal

rhboskres

Publish date: Mon, 07 Sep 2020, 12:20 PM

Maintain short positions. The FKLI staged a sharp positive price reversal to cross above the 200-day SMA line at 1,512 pts – it earlier fell to 1,480 pts, which is near 1,476 pts, the low of 29 Jun. Despite the positive price performance, it was still insufficient to signal that the index’s multi-week retracement phase had reached an end to pave the way for a stronger rebound to develop. Based on the latest price movement, we are of the view that an upside breach of the 1,520-pt resistance would likely signal the possibility for a stronder rebound. Until this happens, we are keeping our negative trading bias.

Traders should remain in short positions. We initiated these at 1,569.5 pts, the closing level of 3 Aug. To manage risks, a stop-loss can now be placed above 1,520 pts.

The immediate support is maintained at 1,500-pt round figure, this is followed by 1,480-pts – the latest low. Towards the upside, the resistance points remain at 1,520 pts and 1,544.5 pts – derived from 3 Sep’s candle.

Source: RHB Securities Research - 7 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024