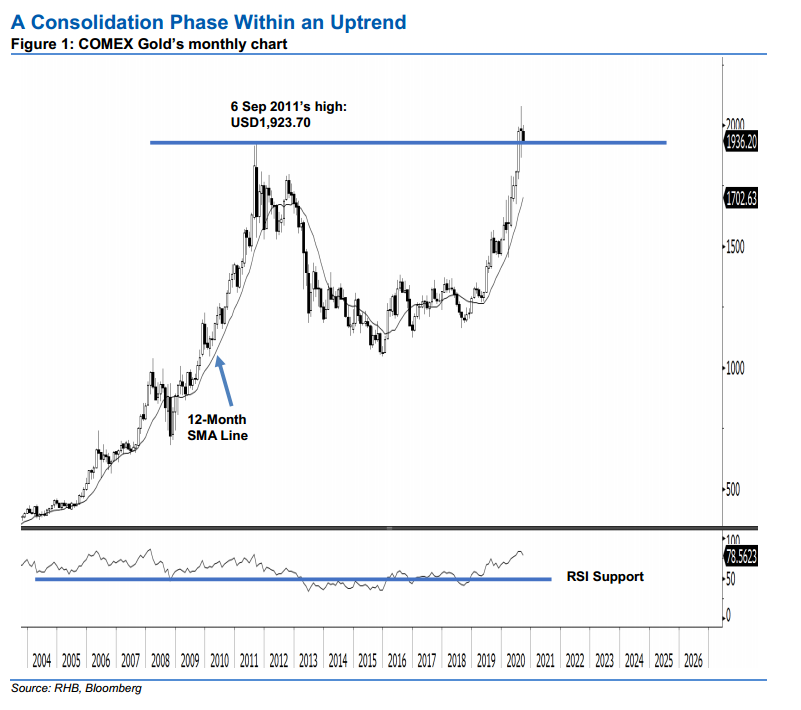

COMEX Gold - A Consolidation Phase Within An Uptrend

rhboskres

Publish date: Tue, 08 Sep 2020, 12:23 PM

Consolidation phase is still incomplete. Today we revisit the COMEX Gold’s long-term price trend. The precious metal resumed its long-term uptrend after it experienced a sharp multi-year correction phase between Sep 2011 and Dec 2015. The current multi-year uptrend has experienced multiple correction phases of varying degrees, both in terms of magnitude and time so far. The latest bout of upward moves took place between June and August, which saw the commodity crossing above Sep 2011’s high. This came on the back of overbought RSI readings across major timeframes, ie daily, weekly and monthly. On these, the commodity has been showing signs of developing a consolidation phase over the past month, and it has yet to show signs of completing – ie the long-term uptrend is not ready to resume yet.

We currently have long positions as we opine that at the lower trading time-frame, there is a good chance for a deeper rebound to develop within the current correction phase. We initiated these at 26 Aug’s closing level of USD1,944.10. For risk-management purposes, a stop-loss can be placed below the USD1,925 mark.

The immediate support is eyed at USD1,909.60, or the low of 21 Aug. This is followed by the USD1,900 round figure. Towards the upside, the resistance point is pegged at USD1,955, and followed by USD1,980.

Source: RHB Securities Research - 8 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024