FCPO - Bulls Remain In Control

rhboskres

Publish date: Wed, 09 Sep 2020, 06:39 PM

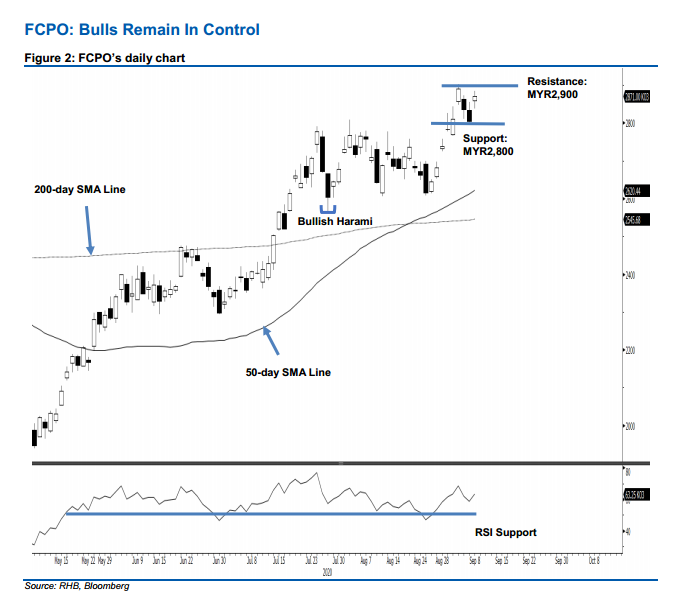

Maintain long positions as bull re-emerged from the MYR2,800 support mark. The FCPO ended the latest session on a strong footing, adding MYR67 to close at MYR2,871. This came after the commodity tested the MYR2,800 support mark in the prior session. As mentioned in our previous note, price actions around the said support are critical in defining the commodity’s next price directional bias ie a downside breach would mark the end of its multi-month uptrend, and this would likely open the door to a lengthy correction phase. For now, we are keeping our positive trading bias.

We advise traders to stay in long positions. We initiated these at MYR2,738, the closing level of 28 Aug. To manage risks, a stop-loss can be now be placed below MYR2,800.

The immediate support is is revised to MYR2,838, which is the latest low. This is followed by MYR2,800. Meanwhile, the immediate resistance is now set at MYR2,885 – the latest high. This is followed by MYR2,900.

Source: RHB Securities Research - 9 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024