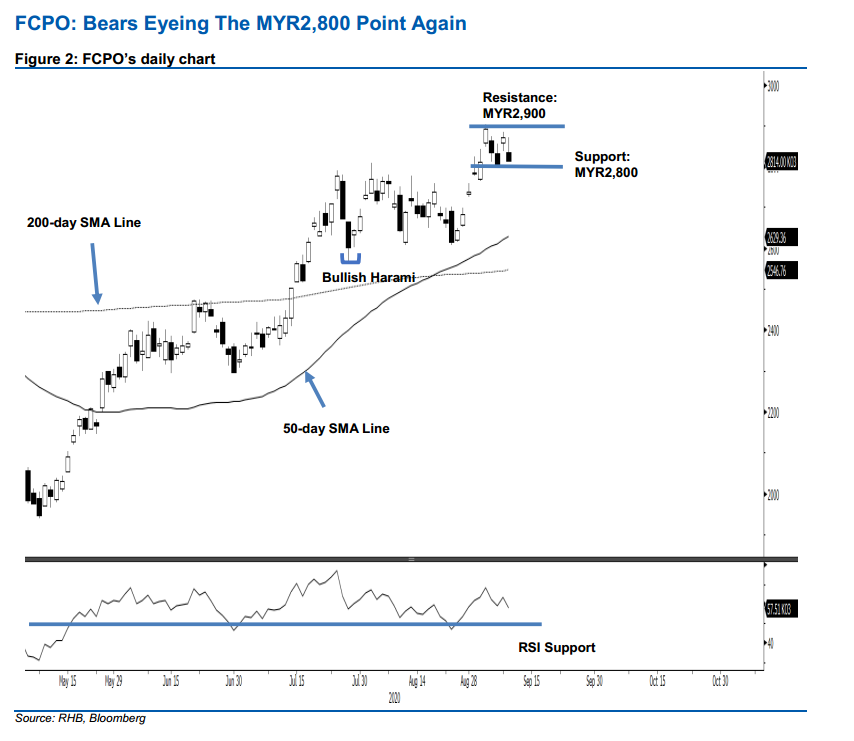

FCPO - Bears Eyeing The MYR2,800 Point Again

rhboskres

Publish date: Thu, 10 Sep 2020, 06:14 PM

Maintain long positions. The FCPO eased MYR57.00 to close at MYR2,814 yesterday, near the session’s low of MYR2,812. The weak close again brought the commodity near the MYR2,800 support mark. We believe price actions around this support level in defining the commodity’s next directional bias – meaning, a downside breach – would likely mark the end of its multi-month uptrend. It would also set the stage for a relatively lengthy correction phase to develop. Until this level is negated, we are maintaining a positive trading bias.

We advise traders to remain in long positions, until the case of a deeper correction phase is confirmed. We initiated these at MYR2,738, the closing level of 28 Aug. To manage risks, a stop-loss can be now be placed below MYR2,800.

The immediate support is revised to MYR2,800, followed by MYR2,765 – the low of 2 Sep. Conversely, the immediate resistance is now expected at MYR MYR2,850 – price point of the latest session. This is followed by MYR2,900.

Source: RHB Securities Research - 10 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024