FKLI - No Respite For The Bulls

rhboskres

Publish date: Thu, 10 Sep 2020, 06:14 PM

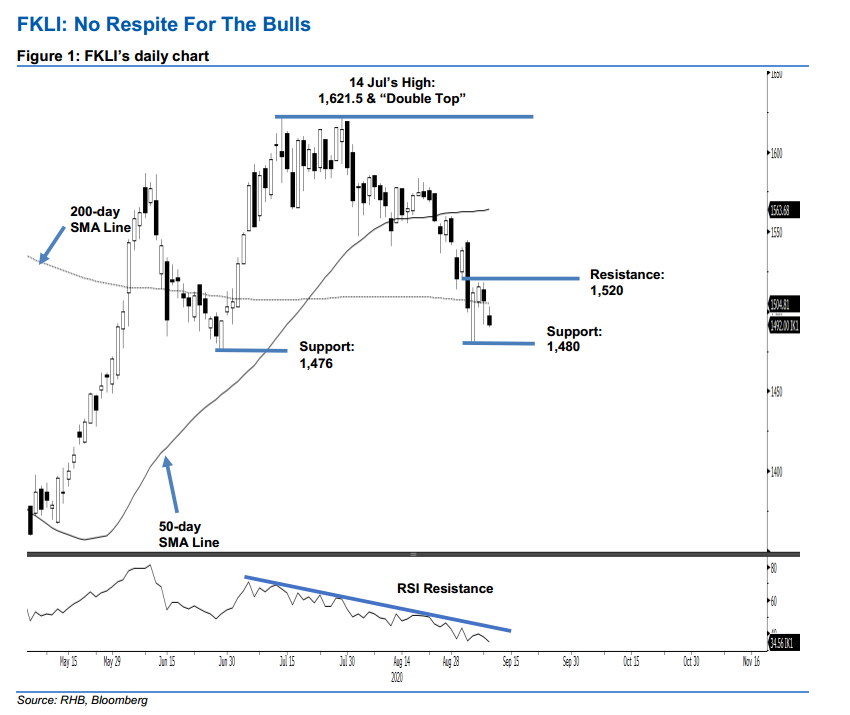

Maintain short positions. The FKLI closed 14.5 pts lower, at 1,492 pts, yesterday. It crossed below both the 1,500-pt immediate support and the 200-day SMA line. These breakdowns are negative from a technical point of view, as both support levels are regarded as important in defining the index’s near-term price trend bias. This is evidenced by the index’s prior sessions, where it attempted to firmly sit above these support marks. Looking at the bigger picture, the index’s multi-week retracement phase is still firmly in place – this is further supported by the RSI reading, which is still capped by the resistance line. As such, we are maintaining a negative trading bias.

Traders should remain in short positions. We initiated these at 1,569.5 pts, the closing level of 3 Aug. To manage risks, a stop-loss can now be placed above 1,520 pts.

The support zone is expected at 1,480 pts – 1,476 pts. Meanwhile, the resistance points are expected at 1,500 pts and round figure and 1,520 pts.

Source: RHB Securities Research - 10 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024