WTI Crude - Moving Down The Trailling-Stop

rhboskres

Publish date: Thu, 10 Sep 2020, 06:17 PM

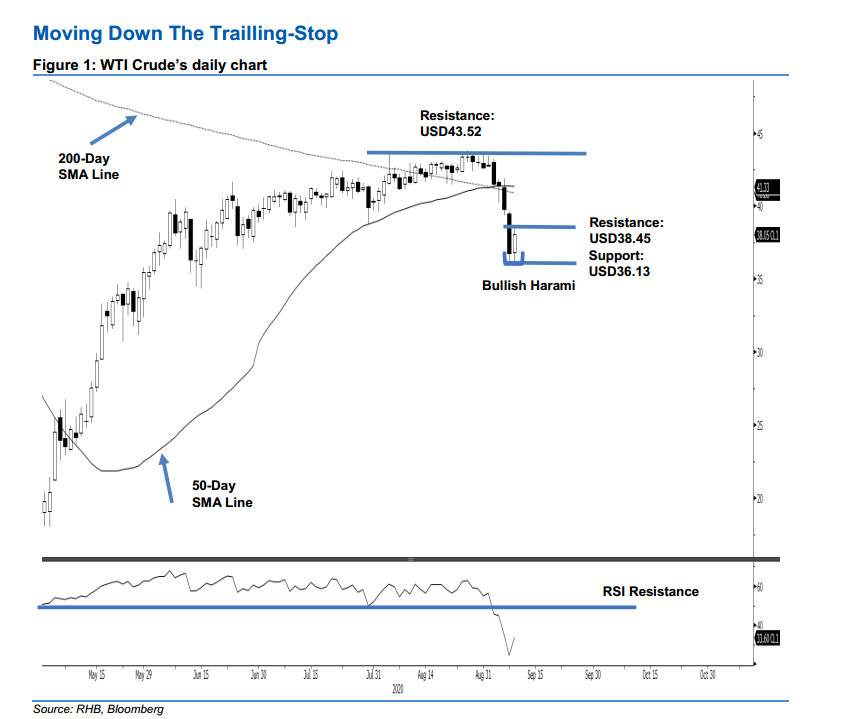

Maintain short positions while tightening risk management on a possible rebound. Yesterday, the WTI Crude ended its four-day cold streak – which saw an accumulated 15% decline – adding USD1.29 to close at USD38.05. Consequently, a “Bullish Harami” formation appeared. Pending further positive price actions to confirm the said formation – which, if it happens, signal a stronger rebound will take place following the abovementioned sharp decline – we are keeping our negative trading bias.

We recommend traders stay in short positons. We initiated these at USD41.37 – the closing level of 3 Sep. To manage risks, a stop-loss can be placed above the USD38.45 mark, which is the latest high.

The immediate support is revised to USD37.15 – the price points of the two most recent sessions. This is followed by USD36.13, which is near the two latest sessions’ low. Conversely, the immediate resistance is eyed at USD38.45, the latest high, followed by USD39.50.

Source: RHB Securities Research - 10 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024