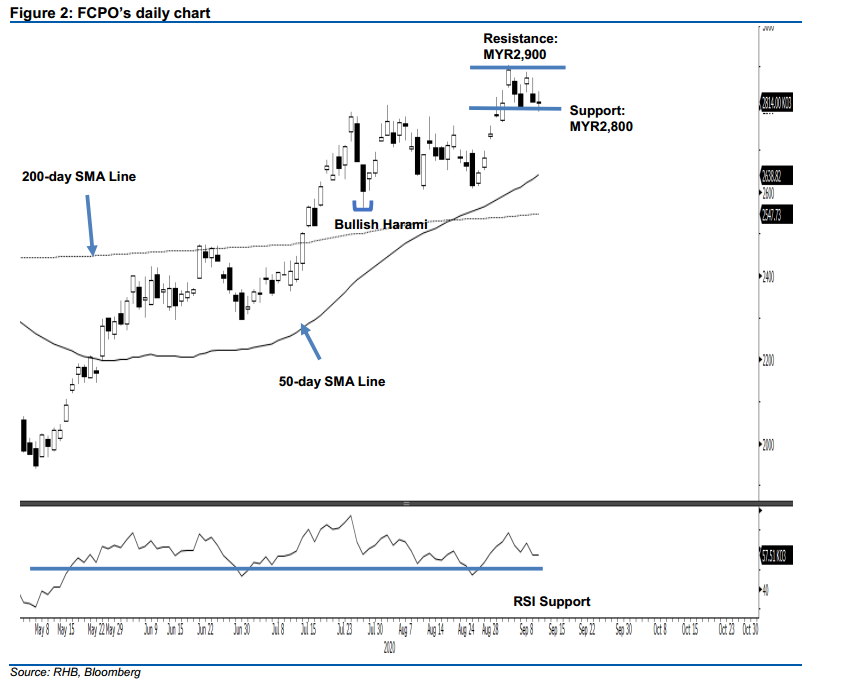

FCPO - MYR2,800 Support Stays The Course

rhboskres

Publish date: Fri, 11 Sep 2020, 11:46 AM

Maintain long positions. The FCPO swung between MYR2,791 and MYR2,840, before closing flat at MYR2,814. With prices continuing to stay above the MYR2,800 support mark, the commodity’s overall upward move remains intact. Price actions around this support level in the coming sessions are crucial in defining the commodity’s next price trend. A downside breach would, in our view, signal the beginning of a deeper correction phase. Until we have the price signal, we are keeping our positive trading bias.

We advise traders to remain in long positions, until a deeper correction phase is confirmed. We initiated these at MYR2,738, the closing level of 28 Aug. To manage risks, a stop-loss can be now be placed below MYR2,800.

The immediate support is maintained at MYR2,800, followed by MYR2,765 – the low of 2 Sep. Towards the upside, the immediate resistance is eyed at MYR MYR2,850 – price point of 9 Sep. This is followed by MYR2,900.

Source: RHB Securities Research - 11 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024