WTI Crude - Bullish Harami Confirmed

rhboskres

Publish date: Thu, 17 Sep 2020, 05:59 PM

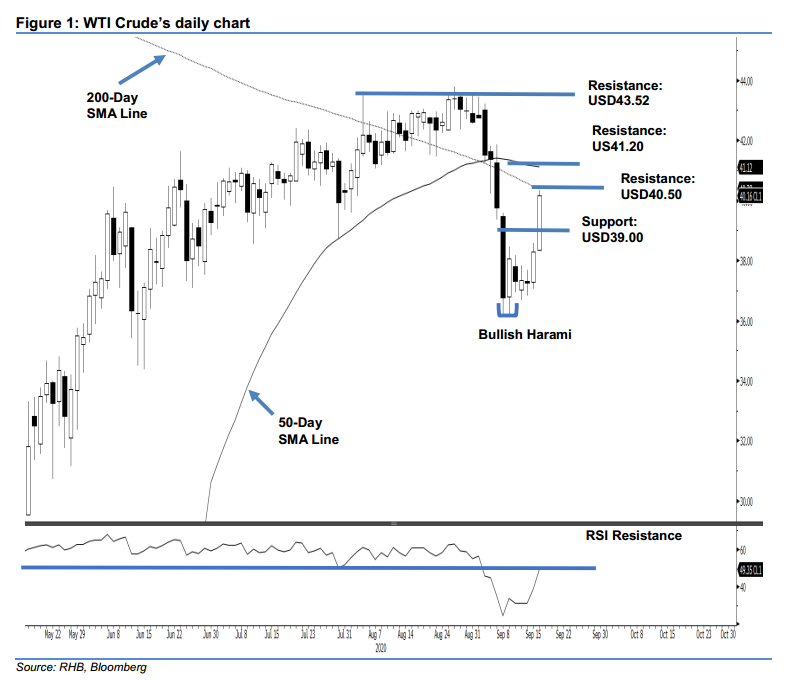

Initiate long positions. The WTI Crude formed a second consecutive white candle to settle the latest session USD1.88 higher at USD40.16. At one point, it tested the 200-day SMA line with a high of USD40.34. With prices settled above the USD38.45 mark, 9 Sept’s “Bullish Harami” formation is now confirmed – indicating prospects for a stronger rebound to take place. This expectation will stay, provided that the black gold holds above the USD38.35 support level. We switch our trading bias from negative to positive.

Our previous short positions, initiated at USD41.37 or the closing level of 3 Sep, were closed out at USD38.45 in the latest session. Concurrently, we initiate long positions. To manage risks, a stop-loss can be placed below USD38.35.

The immediate support is revised to USD39.00, a price point within the latest session, followed by USD38.35, or the latest low. Moving up, resistance points are set at USD40.50 – near the 200-day SMA line – followed by USD41.20, which is near the 50-day SMA line.

Source: RHB Securities Research - 17 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024