COMEX Gold - Still Targeting USD2,000

rhboskres

Publish date: Thu, 17 Sep 2020, 05:59 PM

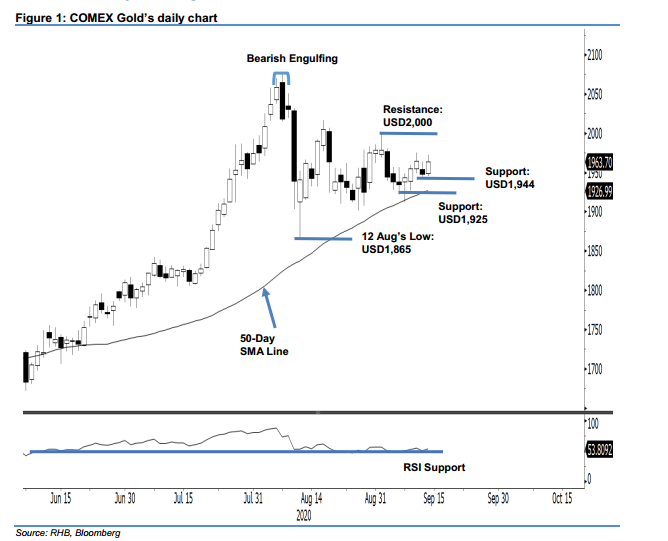

Maintain long positions. The COMEX Gold swung between a low and high of USD1,957.20 and USD1,983.80, before closing USD4.30 higher USD1,970.50. Despite the commodity being unable to sustain a large part of its intraday gains over the past two sessions, we still see it extending its rebound, after recently testing the 50-day SMA line. Towards the upside, our minimum expectation is for the USD2,000 resistance level to be tested. We maintain our positive trading bias.

We advise traders stay in long positions. We initiated these at 26 Aug’s closing level of USD1,944.10. For riskmanagement purposes, a stop-loss can be placed below the USD1,925 mark.

The immediate support is revised to USD1,955 – near the low of 15 Sep, followed by USD1,944, which is the low of 11 Sep. Towards the upside, the resistance point is set at USD1,980, followed by the USD2,000 round figure.

Source: RHB Securities Research - 17 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024