E-Mini Dow - Looking for Further Retracements

rhboskres

Publish date: Mon, 21 Sep 2020, 01:03 PM

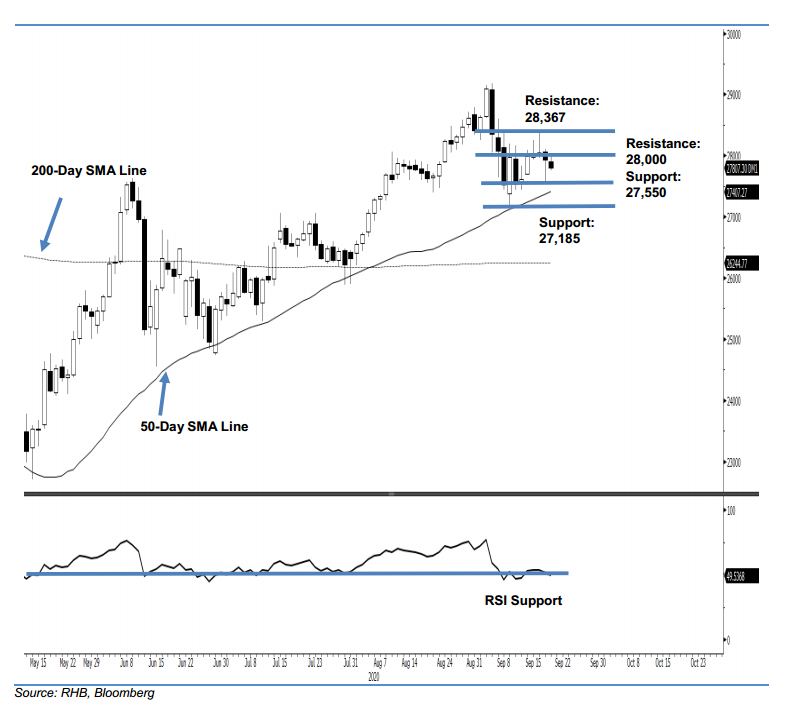

Maintain short positions. The E-mini Dow ceased its latest session 130.7 pts weaker at 27,807.3 pts. The index staged a relatively strong rebound of almost 1,200 pts during 9-19 Sep. This was after it tested the 50-day SMA line on 9 Sep. However, we see this as a counter-trend rebound in nature. Based on the E-min Dow’s past three sessions’ price actions, chances are high that the index’s retracement phase has likely resumed. Towards the downside, we are expecting said SMA line to be breached. Hence, we are keeping to our negative trading bias.

We recommend traders stay in short positions and initiated these at 27,525 pts, or the closing level of 8 Sep. For risk-management purposes, a stop-loss can be placed above the 28,500-pt mark.

The immediate support is revised to 27,550 pts, ie the low of 17 Sep. This is followed by 27,185 pts – the low of 9 Sep. Moving up, the immediate resistance is eyed at the 28,000-pt round figure and followed by 28,367 pts, which was derived from the high of 16 Sep.

Source: RHB Securities Research - 21 Sept 2020