FKLI - Holding Above The 200-Day SMA Line

rhboskres

Publish date: Mon, 21 Sep 2020, 01:04 PM

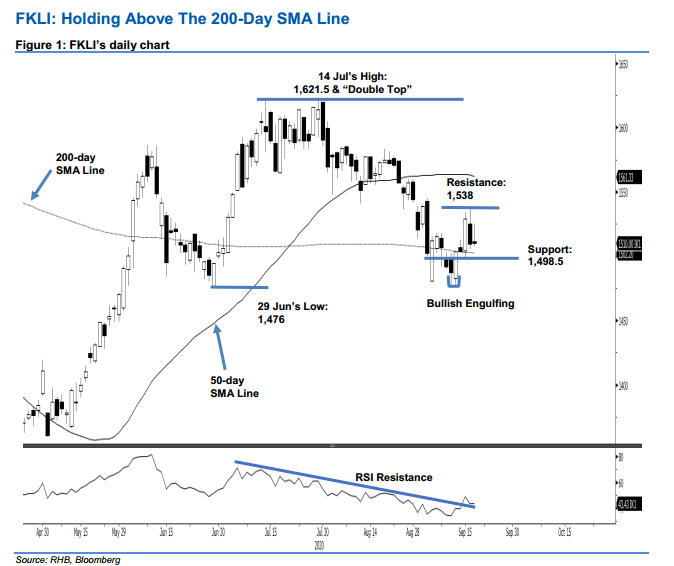

Maintain long positions. Last Friday, the FKLI failed to sustain most of its intraday gains to settle marginally better by 0.5 pts at 1,510 pts – it had earlier hit a high of 1,525 pts. While the latest two sessions are indicating some weakness to the index’s rebound, there is no clear price signal to suggest the rebound has reached a top. Towards the upside, we are still expecting the index to re-test the 50-day SMA line. This positive bias would stay provided the 1,498.5 pts support is not breached. We are keeping our positive trading bias.

We continue to advocate that traders remain in long positions. We initiated these at 1,529 pts – the closing level of 15 Sep. To manage risks, a stop-loss can be set below 1,498.5 pts.

We are keeping the immediate support at 1,498.5 pts, the low of 15 Sep, followed by 1,487 pts – the price point of 11 Sep. Moving up, the immediate resistance is eyed at 1,525 pts – the latest high. This is followed by 1,538 pts, the high of 17 Sep.

Source: RHB Securities Research - 21 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024