WTI Crude - Rebound Hits a Wall

rhboskres

Publish date: Tue, 22 Sep 2020, 01:04 PM

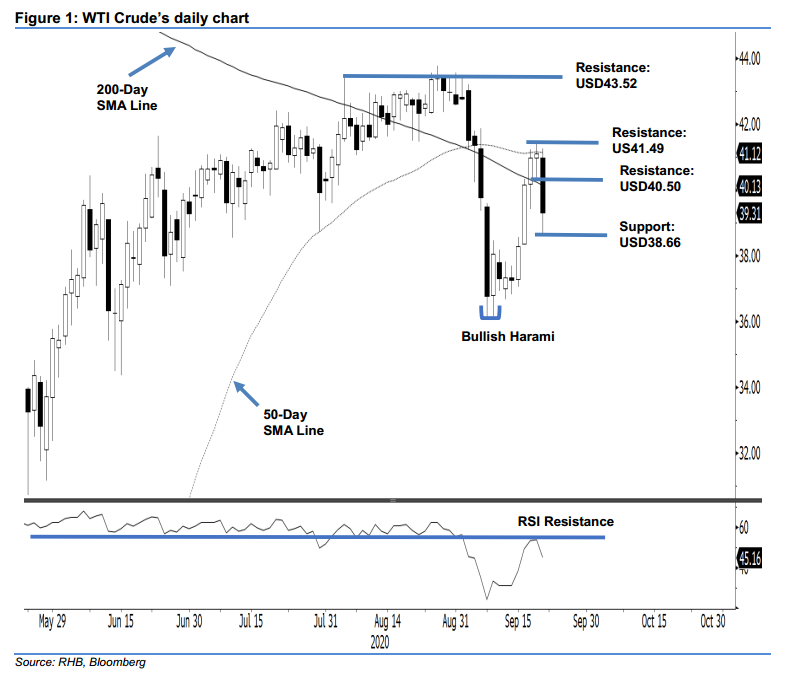

Maintain long positions while revising trailing-stop upwards. After lingering around the 50- and 200-day SMA lines during the two most recent sessions, the WTI Crude experienced a sharp retracement in the latest session, settling below these SMA lines. It reached a high of USD41.27 before closing USD1.80 weaker at USD39.31. Should there be further negative price follow-ups in the coming sessions, ie a downside breach of the latest session’s low of USD38.66, this would signal an end to the commodity’s counter-trend rebound. Until this happens, we are keeping our positive trading bias.

We retain our recommendation for traders to stay in long positions. We initiated these at USD40.16, which is the closing level of 16 Sep. To manage risks, a stop-loss can be placed below USD38.66.

The immediate support is revised to USD38.66 – the latest low. This is followed by USD37.55. Towards the upside, immediate resistance is eyed at USD40.50 – a price point of the latest session. This is followed by USD41.49, or the high of 18 Sep.

Source: RHB Securities Research - 22 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024