FKLI - Rebound Fails To Sustain

rhboskres

Publish date: Tue, 22 Sep 2020, 01:05 PM

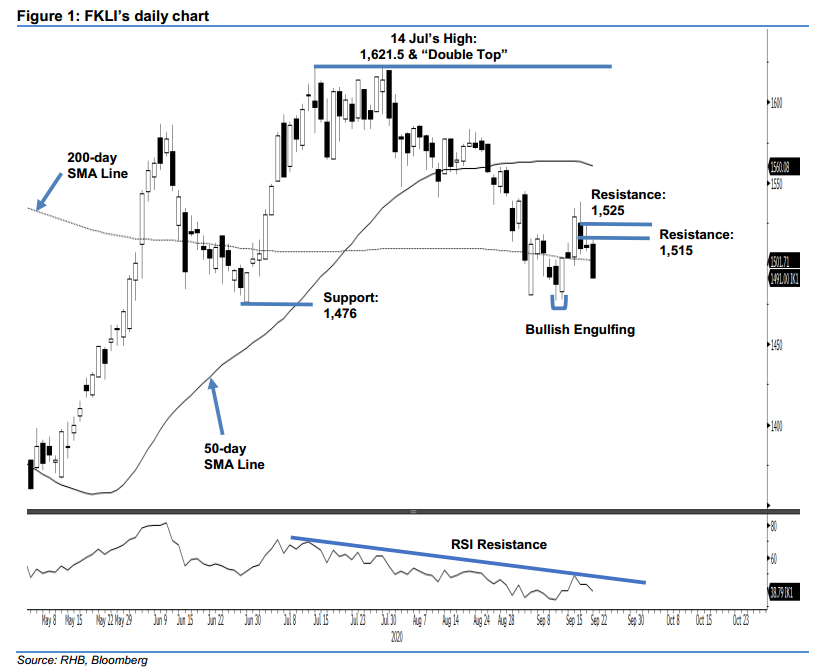

Initiate short positions as the rebound phase has failed to sustain. The FKLI experienced a sharp intraday negative price reversal in the second half of the latest session. The index slid from a high of 1,514.5 pts to close at 1,491 pts – crossing below the 1,498.5-pt support and 200-day SMA line. These negative price signals have, in our view, invalidated the case for the index to extend its counter-trend rebound, which happened following the 11 Sep’s “Bullish Engulfing” formation. As such, we switch our trading bias from positive to negative.

Our previous long positions initiated at 1,529 pts – the closing level of 15 Sep – were closed out in the latest session at 1,498.5 pts. Concurrently, we initiate short positions at the latest closing. To manage risks, a stop-loss can be set above 1,525 pts.

The immediate support is revised to 1,487 pts – the price point of 11 Sep. This is followed by 1,476 pts – the low of 29 Jun. Towards the upside, the immediate resistance is now set at 1,515 pts, followed by 1,525 pts – the high of 18 Sep.

Source: RHB Securities Research - 22 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024