FKLI - Negative Bias Stays

rhboskres

Publish date: Thu, 24 Sep 2020, 05:15 PM

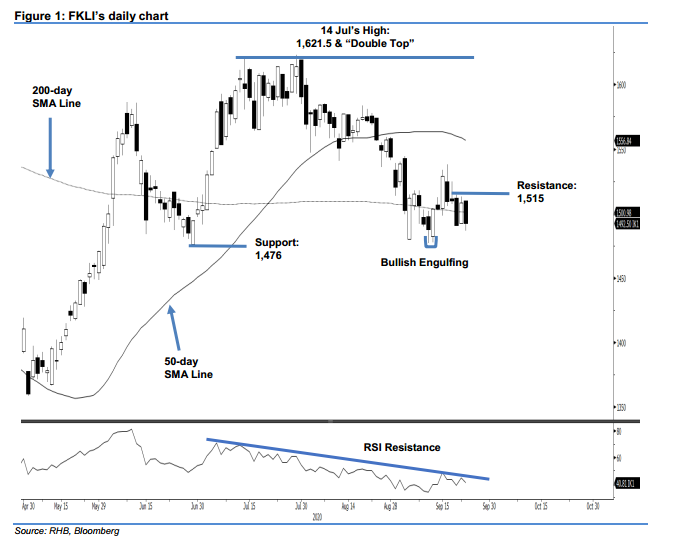

Maintain short positions. The FKLI ceased the latest session 16 pts weaker at 1,492.5 pts. The index has been trading around the 200-day SMA line over the past three sessions and was not able to show signs of staging a positive price reversal from the said line. Hence, we still see a high risk for the index to extend its multi-week retracement, which started from July’s “Double Top” formation. Towards the downside, a breach of the 1,476-pt support – the low of the index’s last upleg which took place between 29 Jun and 14 Jul – would open the door for a deeper retracement to develop. As such, we are keeping our negative trading bias.

We advise traders to stay in short positions. We initiated these at 1,491 pts, which is the closing level of 21 Sep. To manage risks, a stop-loss can be set above 1,525 pts.

The immediate support is revised to 1,476 pts – the low of 29 Jun. This is followed by 1,457 pts, which is the low of 1 Jun. Moving up, the resistance points are pegged at 1,500 pts and 1,515 pts.

Source: RHB Securities Research - 24 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024