WTI Crude - Moving Up the Trailling-Stop

rhboskres

Publish date: Thu, 24 Sep 2020, 05:16 PM

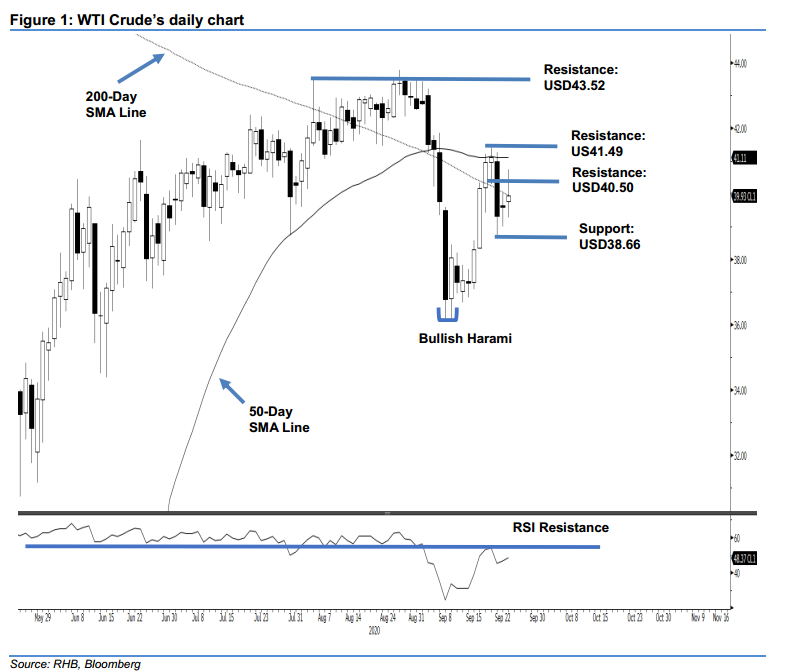

Maintain long positions. The WTI Crude gave back a good part of its intraday gains to settle at USD39.93 – indicating a USD0.33 gain. Earlier on, it reached a USD40.75 high. While the black gold has been developing a minor rebound over the past two sessions, it is still struggling to overcome the 50-day SMA line. This rebound set in following the decline on 21 Sep, which saw the commodity being rejected from both the 50- and 200-day SMA lines. Based on these observations, we believe – should the latest USD39.26 low fail to hold in the coming sessions – the risk for further price retracements will be high. Until this happens, we are keeping to our positive trading bias.

We retain our recommendation for traders to stay in long positions. We initiated these at USD40.16, which was the closing level of 16 Sep. To manage risks, a stop-loss can be placed below the USD39.26 level.

The immediate support is revised to USD39.26 – the latest low – and followed by USD38.66, which was the low of 21 Sep. Conversely, the immediate resistance is maintained at USD40.50. This is followed by USD41.49, or the high of 18 Sep

Source: RHB Securities Research - 24 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024