Hang Seng Index Futures - Clawing TowardsResistance

rhboskres

Publish date: Tue, 29 Sep 2020, 10:38 AM

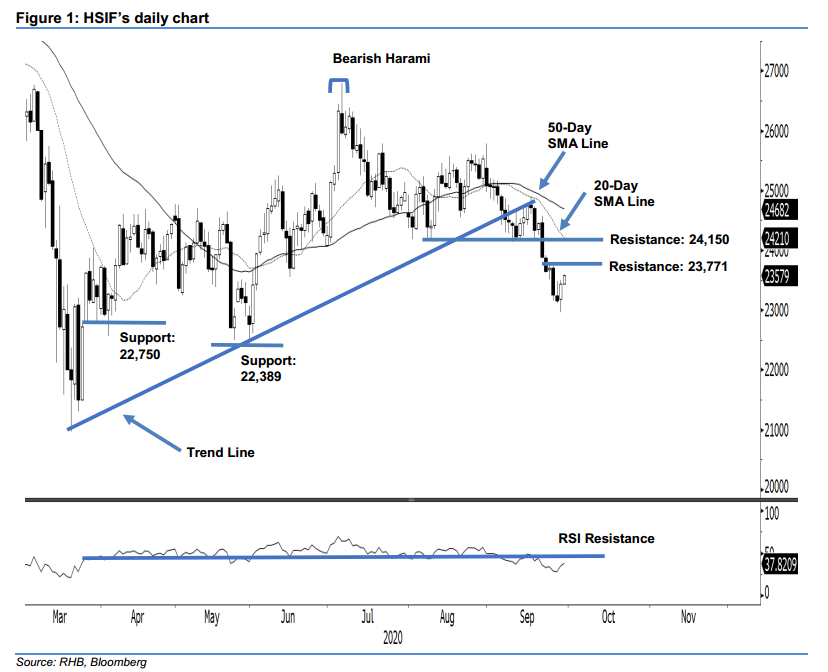

Maintain short positions. The HSIF rebounded 283 pts to close at 23,435 pts. We deem that the heavy sell-down which happened on 24 Sep is still exerting selling pressure on the HSIF – a close above the resistance of 23,771 pts will warrant a meaningful rebound towards the 20-day SMA line. Meanwhile, the gap between the 20-day SMA line and 50-day SMA line is widening, indicating we are still in a downtrend mode. In conclusion, we are keeping to our negative trading bias until the resistance level is breached.

We advise traders to stay in short positions. We initiated these at 24,924 pts, which was the closing level of 3 Sep. For risk-management purposes, we keep the trailing stop-loss level at the 23,771-pt mark, which was the day high of 24 Sep.

The support level is marked at 22,750 pts, ie the low of 30 Mar. This is followed by the 22,389-pt mark, which was the day low of 29 May. Moving up, the immediate resistance is set at 23,771 pts, followed by the 24,150-pt mark, the low of 7 Aug.

Source: RHB Securities Research - 29 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024