WTI Crude - Volatile Trading

rhboskres

Publish date: Tue, 06 Oct 2020, 10:34 AM

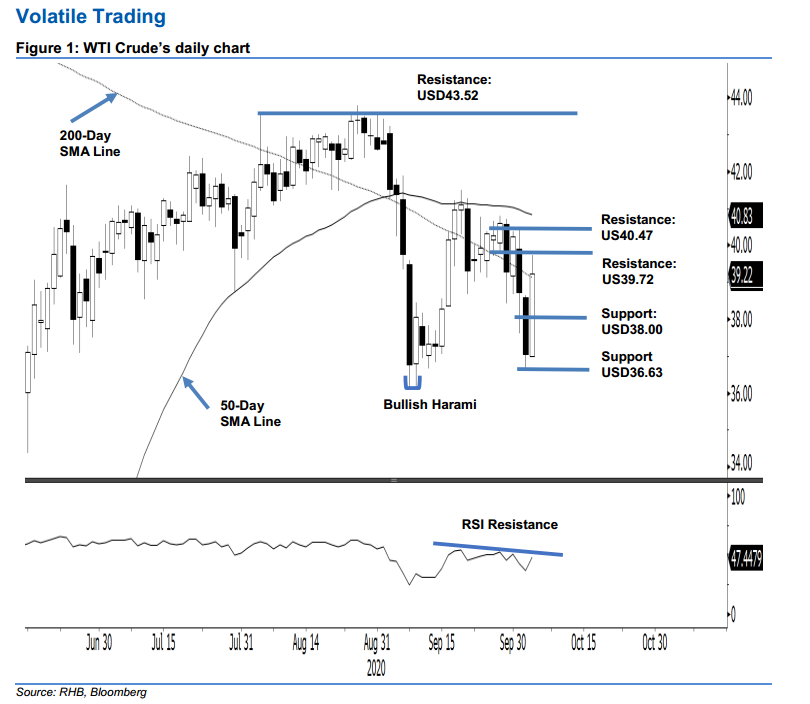

Initiate long positions. The WTI Crude staged a strong comeback in the latest session to erase its prior session’s loss. It settled USD2.17 stronger at USD39.22 to marginally cross above the 50-day SMA line. Price volatility remained high over the past three sessions. However, with the latest strong positive pushback, after the commodity came in near 9 Sep’s “Bullish Harami” formation in the previous session, this seems to suggest the commodity may still not be ready to extend its retracement that started from the failed attempt to cross above the USD43.52 resistance back in end-August. Hence, we switch our trading bias from negative to positive.

Our previous short positions initiated at USD38.72, which is the closing level of 1 Oct, were closed out at breakeven in the latest session. Concurrently, we initiate long positions. To manage risks, a stop-loss can be placed below USD38.00.

The immediate support is revised to USD38.00, followed by USD36.63 – the low of 2 Oct. On the upside, the immediate resistance is set at the latest high of USD39.72, followed by USD40.47 – the high of 1 Oct.

Source: RHB Securities Research - 6 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024