COMEX Gold - Still Looking Good

rhboskres

Publish date: Tue, 06 Oct 2020, 10:36 AM

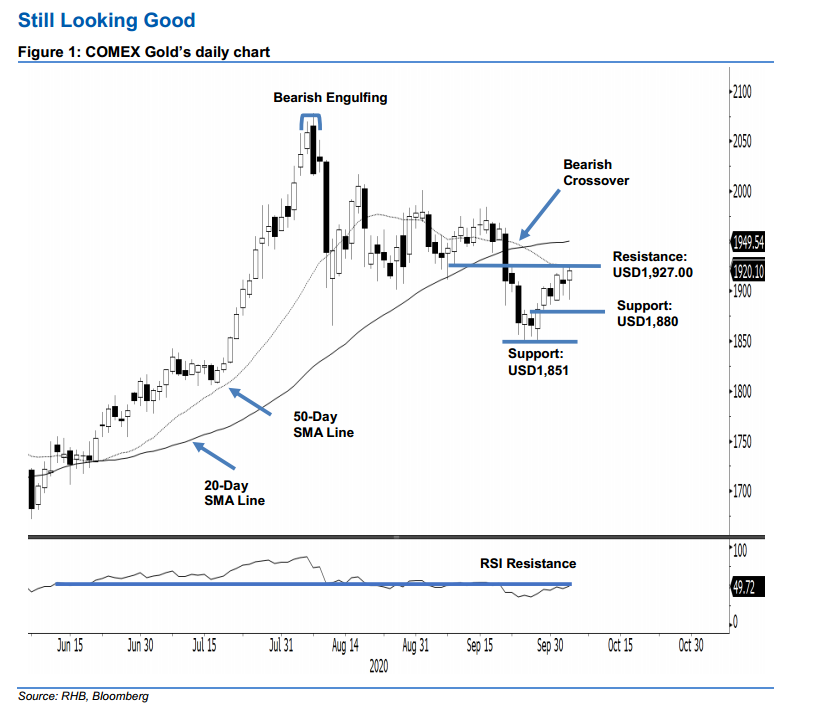

Maintain long positions. The COMEX Gold reversed its prior session’s weak closing to hand in a gain of USD12.50 at USD1,920.10 – the high was posted at USD1,924.90. The positive performance placed the precious metal on the verge of breaking out from the 20-day SMA line. Recall that our minimum expectation is for this rebound phase to test the resistance zone that consists of the 20- and 50-day SMA lines. While the RSI reading is still below the neutral threshold, do note that is has been moving higher, an encouraging momentum observation. Maintain our positive trading bias.

We recommend traders maintain long positions. We initiated these positions at USD1,903.20, ie the closing level of 29 Sep. For risk-management purposes, a stop-loss can now be placed below USD1,880.

The immediate support level stays at USD1,880 – the low of 29 Sep. This is followed by USD1,851, which is near 28 Sep’s low. On the upside, the immediate resistance is set at USD1,927 – around the 20-day SMA line. This is followed by USD1,950.

Source: RHB Securities Research - 6 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024