FKLI - Attempting To Breach the Resistance Zone

rhboskres

Publish date: Tue, 06 Oct 2020, 11:48 AM

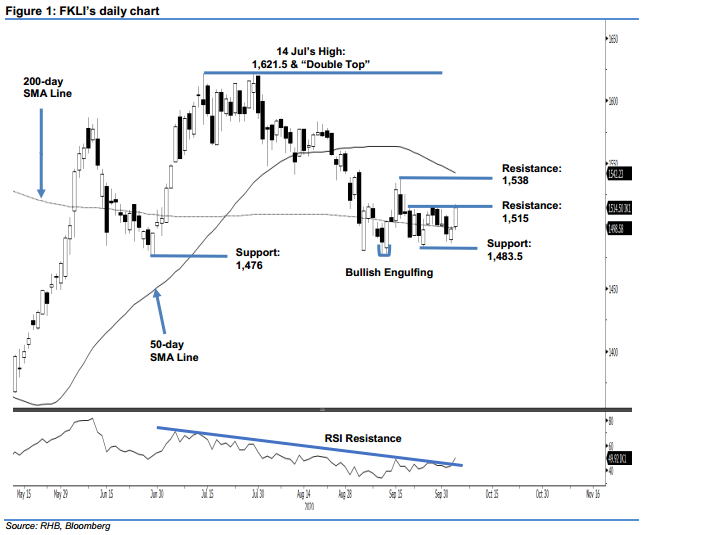

Maintain short positions. The FKLI formed a second consecutive white candle and in the process, attempted to breach the 1,500-1,515-pt resistance zone with a high of 1,517.5 pts, before ending 17 pts higher at 1,514.5 pts ie above the 50-day SMA line. Closing above 1,515-pt resistance would signal the rebound that set in following 11 Sep’s “Bullish Engulfing” is still able to extend. Note that the RSI has managed to cross above the resistance line (as drawn in the chart) – suggesting improved momentum. However, pending a clean breakout from the 1,515-pt mark, we are keeping our negative trading bias.

We advise traders to remain in short positions. We initiated these at 1,491 pts, the closing level of 21 Sep. To manage risks, a stop-loss can be set above 1,515 pts.

The immediate support is revised to the round figure of 1,500 pts, this is followed by 1,483.5 pts, the low of 24 Sep. Conversely, the immediate resistance is pegged at 1,515 pts, followed by 1,538 pts ie the high of 17 Sep

Source: RHB Securities Research - 6 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024