FCPO - Tightening Up Risk Management Further

rhboskres

Publish date: Tue, 06 Oct 2020, 11:49 AM

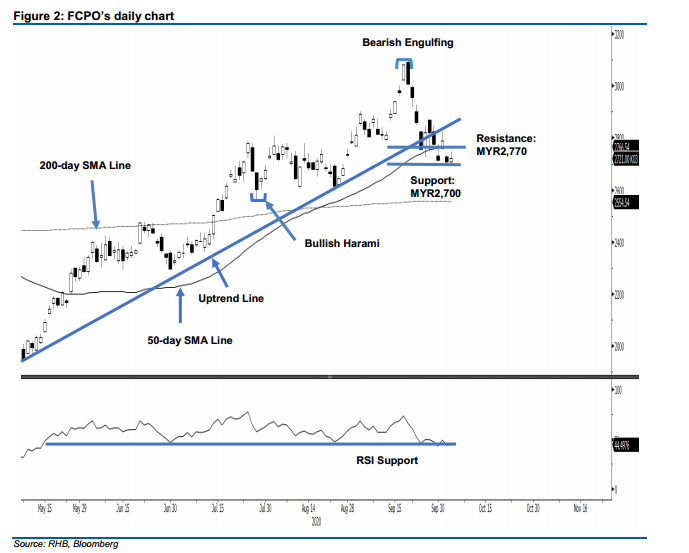

Maintain short positions while keeping an eye on a possible counter-trend rebound kicking in. The FCPO experienced a positive intraday price reversal as it rebounded from a low of MYR2,691 to a high of MYR2,747, before closing MYR13 higher at MYR2,721. The positive session can be seen as a possible early indication that the bulls are attempting to stage a counter-trend rebound. This comes after its past 1.5 weeks’ price retracement is now showing signs of losing momentum despite trading below the 50-day SMA and the multi-week uptrend lines. Based on the latest intraday price actions, should the latest high be breached in the coming sessions, we believe this will confirm the possibility for a counter-trend rebound phase to kick in. For now, stay with our negative trading bias.

We recommend that traders stick to short positions. We initiated these at MYR3,007, the closing level of 21 Sep. To manage risks, a stop-loss can be placed above MYR2,747.

The immediate support is maintained at MYR2,700, follow by MYR2,670. Moving up, the immediate resistance is set at MYR2,730 – a price point of 2 Oct, this is followed by MYR2,770.

Source: RHB Securities Research - 6 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024