E-Mini Dow - Price Reversal Formation Appears

rhboskres

Publish date: Wed, 07 Oct 2020, 04:39 PM

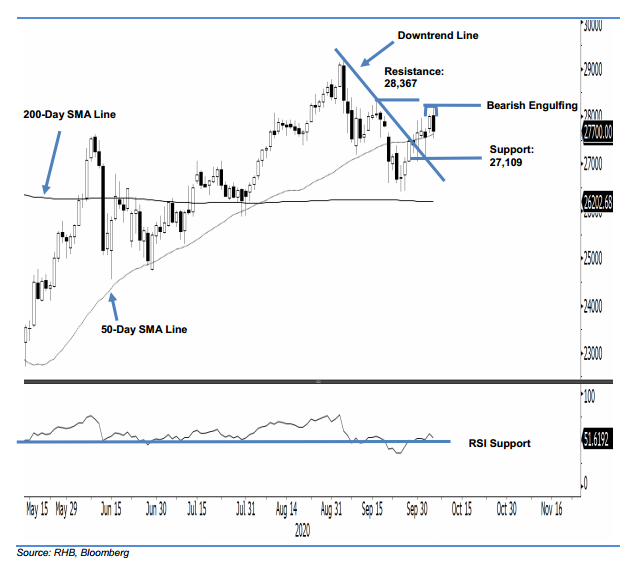

Maintain short positions. The E-mini Dow failed in its second consecutive attempt to cross above the 28,000-pt resistance point. After hitting a high of 28,232 pts, the index slid to close 95 pts weaker at 27,700 pts. Consequently, a “Bearish Engulfing” formation appeared – likely indicating its two-week counter-trend rebound has reached an end. As mentioned in our previous reports, while the index is still located above both the 50-day SMA line and the multi-week resistance line, a closing above the 28,000-pt resistance is needed to signal a valid breakout. Hence, we are keeping our negative trading bias.

We recommend traders stay in short positions, and initiated these at 27,525 pts, or the closing level of 8 Sep. For risk-management purposes, a stop-loss can now be placed above the 28,000-pt mark.

The immediate support is maintained at 27,500 pts, followed by 27,109 pts. Meanwhile, the immediate resistance is set at the 28,000-pt round figure, followed by 28,367 pts, which was the high of 16 Sep.

Source: RHB Securities Research - 7 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024