Hang Seng Index Futures - Moving Into Rebound Target Zone

rhboskres

Publish date: Thu, 08 Oct 2020, 04:58 PM

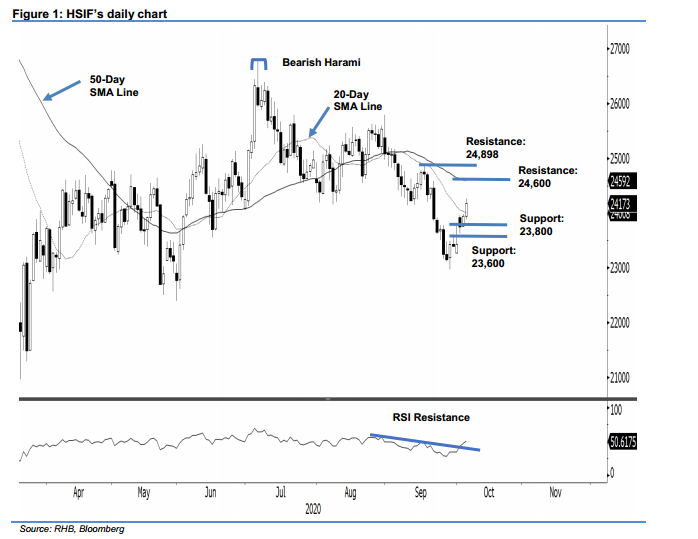

Maintain long positions. The HSIF extended its 1-week counter-trend rebound, adding 222 pts to close at 24,173 pts, marginally above the previous immediate resistance of 24,100 pts. The advancement has also placed the index in the resistance zone that consists of the 20- and 50-day SMA lines. Recall that our expectation is for the ongoing counter-trend rebound to reach the 24,500-pt area. Also, the RSI has crossed above the resistance line (as drawn in the chart), a positive momentum observation. Maintain our positive trading bias.

As the counter-trend rebound is still extending, we maintain our long recommendation. We initiate these positions at 23,951 pts, the closing level of 6 Oct. For risk-management purposes, a stop-loss can be placed below 23,800 pts.

The immediate support is revised to 23,800 pts, followed by 23,600 pts. On the upside, the immediate resistance is revised to 24,600 pts, near the 50-day SMA line, followed by 24,898 pts – the high of 16 Sep.

Source: RHB Securities Research - 8 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024