WTI Crude - No Price Rejection Signal

rhboskres

Publish date: Thu, 08 Oct 2020, 05:02 PM

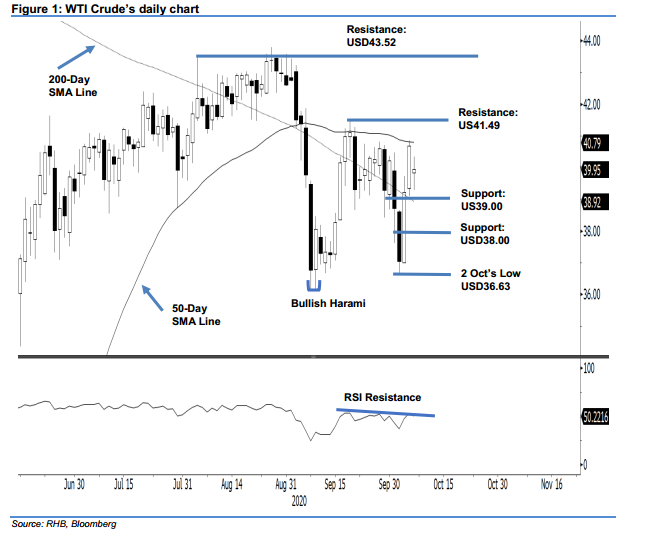

Maintain long positions. The WTI Crude softened USD0.72 to close at USD39.95 following the prior two sessions’ sharp rebound off 2 Oct’s low of USD36.63. We treat the weak session as a result of profit-taking activity, and it did not flash out a price exhaustion or rejection signal from the resistance zone made up of the 50- and 200-day SMA lines. Additionally, the RSI is now slightly above the neutral reading and seems near a breakout from its resistance line. Hence, we are keeping our positive trading bias.

As the rebound that started from 9 Oct’s “Bullish Harami” is still showing good signs of extending, we recommend traders to stay in long positions. We initiated these at USD39.22, the closing level of 5 Oct. To manage risks, a stop-loss can be placed below USD38.00.

Support levels are maintained at USD39.00 – near the 50-day SMA line, followed by the USD38.00 round figure. Conversely, the immediate resistance is marked at 18 Sep’s high of USD41.49, followed by USD42.00.

Source: RHB Securities Research - 8 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024