COMEX Gold - Pending Price Rejection Confirmation

rhboskres

Publish date: Thu, 08 Oct 2020, 05:20 PM

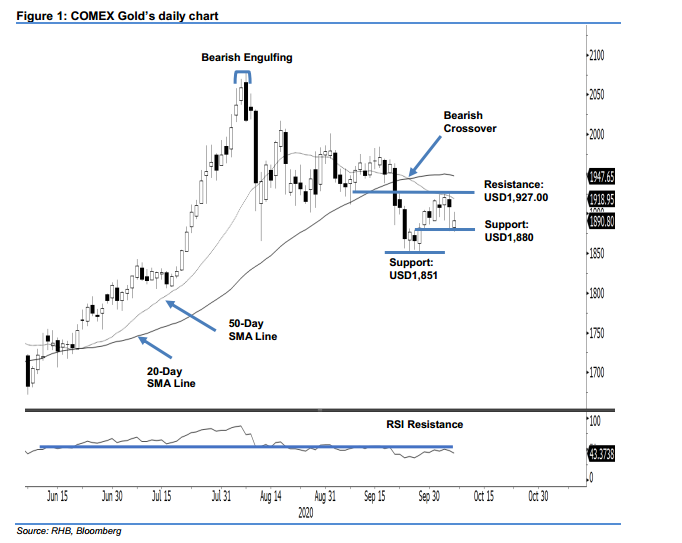

Maintain long positions. The COMEX Gold ended the latest session USD18.00 weaker at USD1,890.80, extending its previous session’s weak closing after a failed attempt to cross above the 20-day SMA line – indicating a possible price rejection – potentially marking the end of the commodity’s over one-week counter-trend rebound, which started from the low of USD1,851 on 28 Sep. This possibility will be confirmed should the USD1,880 support be breached in the coming sessions. For now, we are keeping our positive trading bias.

We recommend traders maintain long positions. We initiated these positions at USD1,903.20, ie the closing level of 29 Sep. For risk-management purposes, a stop-loss can now be placed below USD1,880.

The immediate support level is maintained at USD1,880 – the low of 29 Sep. This is followed by USD1,851, which is near 28 Sep’s low. On the upside, the immediate resistance is revised to the USD1,900 round figure, followed by USD1,927 – around the 20-day SMA line.

Source: RHB Securities Research - 8 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024