FKLI - Bulls In Defense Mode

rhboskres

Publish date: Fri, 09 Oct 2020, 04:25 PM

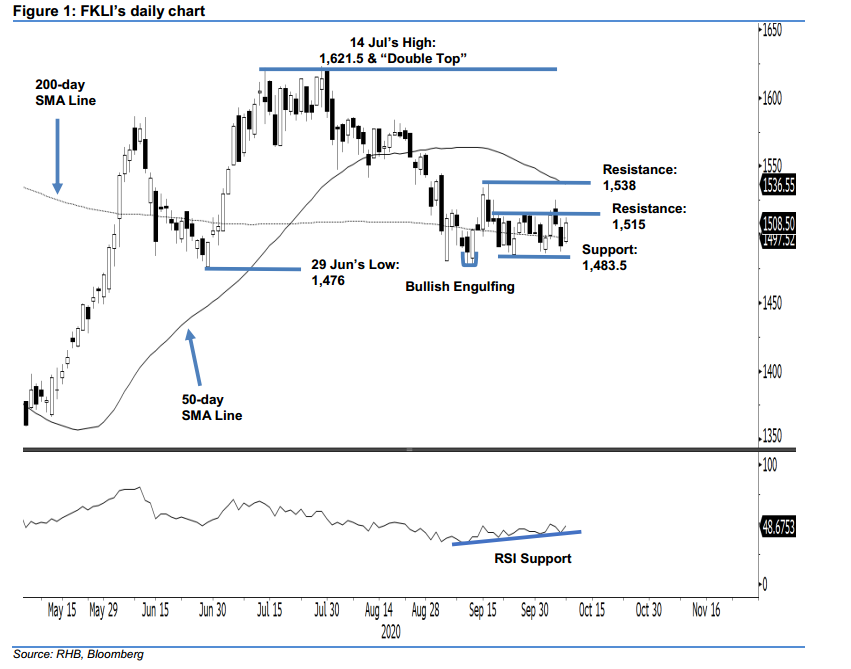

Maintain short positions. The FKLI closed 17 pts higher at 1,508.5 pts yesterday, fully recouping the prior session’s losses. It also placed the index back into the resistance zone of 1,500-1,515 pts. The positive session can be regarded as an attempt by the bulls to defend the 11 Sep “Bullish Harami” formation. An invalidation of this formation would trigger further downward pressure on the index. Recall that the formation appeared near the 29 Jun low of 1,476 pts, ie the low prior to the index’s previous final upward leg. Towards the upside, provided the index is still capped by 1,515 pts, we are maintaining a negative trading bias.

As the index failed to extend its rebound, traders should remain in short positions. We initiated these at 1,491 pts, the closing level of 21 Sep. To manage risks, a stop-loss can be set above 1,515 pts.

We also revise the immediate support to 1,500 pts, followed by 1,483.5 pts, the low of 24 Sep. On the upside, the immediate resistance is now at 1,515 pts, followed by 1,538 pts – the high of 17 Sep

Source: RHB Securities Research - 9 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024