Hang Seng Index Futures - No Reversal Signals

rhboskres

Publish date: Fri, 09 Oct 2020, 05:01 PM

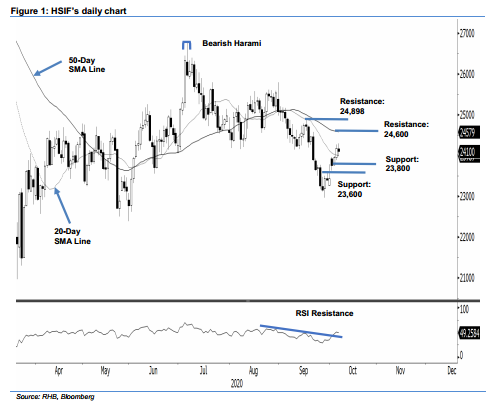

Maintain long positions. The HSIF paused its gains during the latest trade, ending 73 pts lower at 24,100 pts. The minor decline is a reflection of profit-taking activities, and does not signal a price exhaustion or rejection from the resistance zone which consists of the 20- and 50-day SMA lines. All in, we are still seeing a good chance for the rebound to reach the 24,500-pt area – further supported by the improved RSI reading. We maintain our positive trading bias.

As the counter-trend rebound is still extending, we maintain our long recommendation. We initiated these positions at 23,951 pts, the closing level of 6 Oct. For risk-management purposes, a stop-loss can be placed below 23,800 pts.

We are keeping the immediate support at 23,800 pts, followed by 23,600 pts. Moving up, the immediate resistance is set at 24,600 pts, near the 50-day SMA line, followed by 24,898 pts – the high of 16 Sep.

Source: RHB Securities Research - 9 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024