COMEX Gold: the Bulls Power Higher

rhboskres

Publish date: Mon, 12 Oct 2020, 10:50 AM

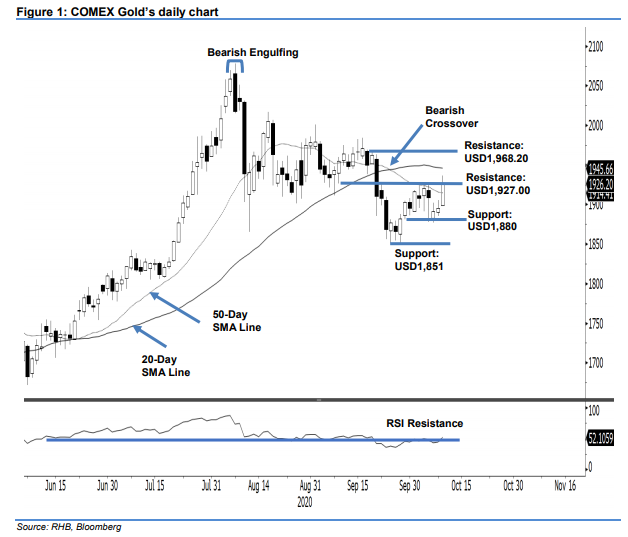

Maintain long positions. The COMEX Gold has resumed the bullish movement, gapping up to open at USD1,898.40 and surging to a day high of USD1,936.80 before retracing slightly lower to close near to the day high at USD1,926.20. The bullish candle has recovered the brief corrections made on 7 Oct and 8 Oct. With the latest session trading above the 20-day SMA line, we do expect the commodity to test the 50-day SMA line soon. Eventually, it will need to trade above the 50-day SMA line to nullify the bearish crossover of the two moving averages. We are anticipating the higher resistance level at USD1,968.20, which was the day high of 18 Sep. For now, we are keeping to our positive trading bias.

We recommend traders maintain long positions. We initiated these positions at USD1,903.20, ie the closing level of 29 Sep. For risk-management purposes, a stop-loss can be placed below the USD1,880 mark.

The immediate support level is maintained at USD1,880, or the low of 29 Sep. This is followed by USD1,851, which was 28 Sep’s low. Conversely, the immediate resistance is pegged at the USD1,927 and followed by USD1,968.20.

Source: RHB Securities Research - 12 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024