FKLI: Bulls Are Extending Rebound

rhboskres

Publish date: Mon, 12 Oct 2020, 10:56 AM

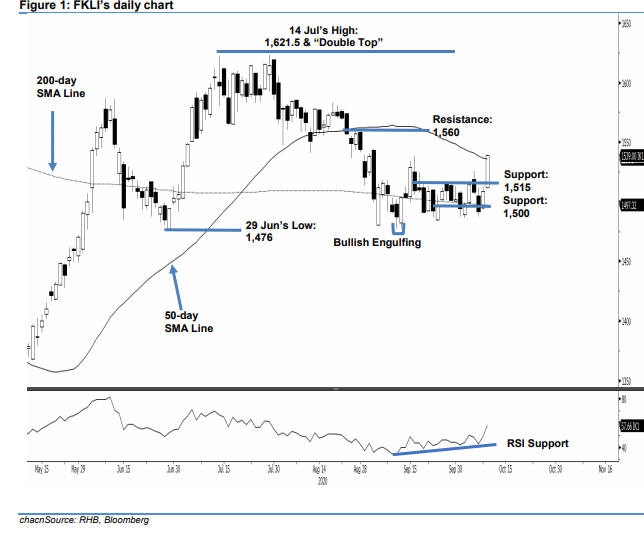

Initiate long positons. The FKLI closed a strong footing last Friday, adding 30.5 pts to end at 1,539 pts, and crossing above the 1,538-pt resistance and the 50-day SMA lines marginally. With the upside breach of the 1,515-pt mark – which has acted as a strong resistance over the past three weeks – chances are high that the index would be able to extend its rebound that started from 11 Sep’s “Bullish Engulfing” formation. The formation appeared near the crucial support of 1,476 pts, which was the low prior to the index’s previous final up-leg that took place between end-June and the first half of July. We switch our trading bias from negative to positive.

Our previous short positions – initiated at 1,491 pts, the closing level of 21 Sep – were closed out in the latest session. Concurrently, we initiate long positions. To manage risks, a stop-loss can be placed below 1,515 pts.

We also revise the immediate support to 1,515 pts, followed by 1,500 pts. Meanwhile, the immediate resistance is revised to 1,545 pts, followed by 1,560 pts

Source: RHB Securities Research - 12 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024