FKLI: No Positive Follow-Through

rhboskres

Publish date: Tue, 13 Oct 2020, 10:41 AM

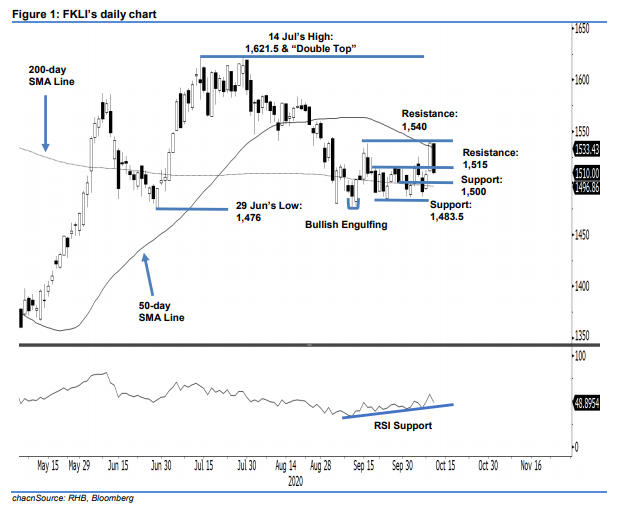

Bulls failed to sustain rebound extension; initiate short positons. The FKLI failed to stage a positive followthrough from last Friday’s strong performance, ending the latest session 29 pts weaker at 1,510 pts. The sharp decline saw the index fall back to the 1,500-1515-pt zone – one session after breaching the zone last Friday. This can be seen as a price rejection signal from the 50-day SMA line and has nullified our expectations for the index to extend it multiweek rebound phase. Hence, we switch our trading bias from positive to negative.

Our previous short positions, initiated at 1,539 pts – the closing level of 9 Oct – were closed out at the latest session at 1,515 pts. Concurrently, we initiate short positons. To manage risks, a stop-loss can be placed above 1,540 pts.

The immediate support is revised to the round figure of 1,500 pts, followed by 1,583.5 pts – the low of 24 Sep. On the upside, the immediate resistance is revised to 1,515 pts, followed by 1,540 pts.

Source: RHB Securities Research - 13 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024