WTI Crude: Possible Rejection From the SMA Lines

rhboskres

Publish date: Tue, 13 Oct 2020, 11:04 AM

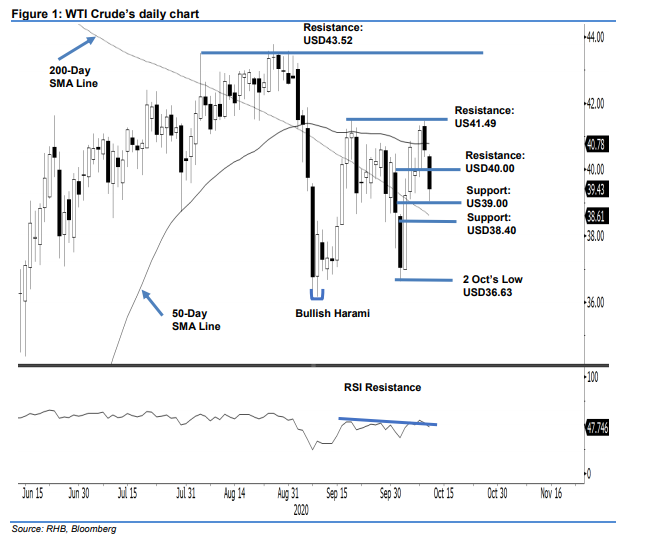

Maintain long positions. The WTI Crude ended the latest session USD1.17 weaker at USD39.43 – the low was recorded at USD39.04. This second consecutive weak close now places the commodity back into the zone that consists of the 50- and 200-day SMA lines – the WTI Crude briefly stayed above this zone last week. Until further negative price actions are observed during the coming sessions – to signal a valid price rejection from said zone – we continue to see the counter-trend rebound, which started from 9 Sep’s “Bullish Harami” pattern, remaining in place. Hence, we are keeping to our positive trading bias.

With no price exhaustion signal spotted, we recommend traders stay in long positions. We initiated these at USD39.22, or the closing level of 5 Oct. To manage risks, a stop-loss can be placed at the breakeven level.

The immediate support is revised to USD39.00 – near the 50-day SMA line. This is followed by USD38.40, ie a price point of 2 Oct and 5 Oct. On the upside, the immediate resistance is now eyed at the USD40.00 round figure and followed by 18 Sep’s high of USD41.49

Source: RHB Securities Research - 13 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024