COMEX Gold - Moving Down From Resistance Point

rhboskres

Publish date: Wed, 14 Oct 2020, 04:52 PM

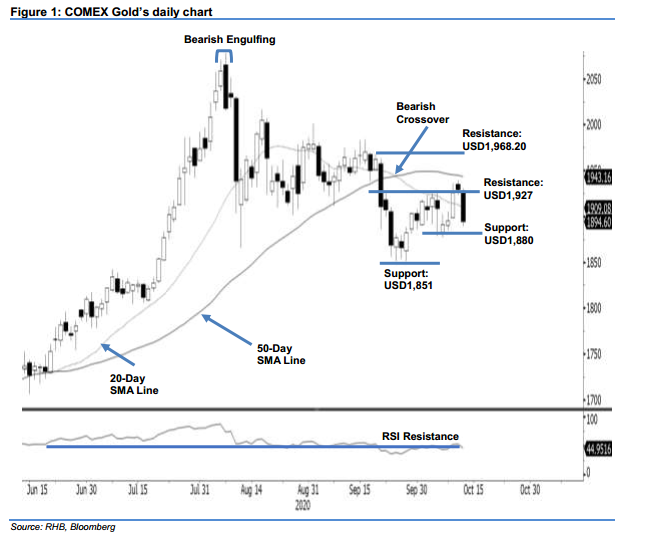

Maintain long positions. The COMEX Gold slipped after failing to establish a foothold above the USD1,927 resistance level. The precious metal started the session at USD1,927.3, moving up to a session high of USD1,930.60. However, as the resistance was too strong, it was sold down USD36.00 to close near the session’s low of USD1,894.6. The precious metal ended USD34.30 lower than previous session. As mentioned previously, we still think that the higher lows, which started from USD1,851, will provide support for the precious metal. Trading opportunities will arise, should the precious metal trade near the lower boundaries. For now, we are keeping to our positive trading bias.

We recommend traders maintain long positions. We initiated these positions at USD1,903.20, or the closing level of 29 Sep. For risk-management purposes, a stop-loss is set at the USD1,880 mark.

The immediate support level is maintained at USD1,880, or the low of 29 Sep. This is followed by USD1,851, which was 28 Sep’s low. Meanwhile, the immediate resistance is kept at USD1,927, and followed by USD1,968.20, which is the high of 18 Sep

Source: RHB Securities Research - 14 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024