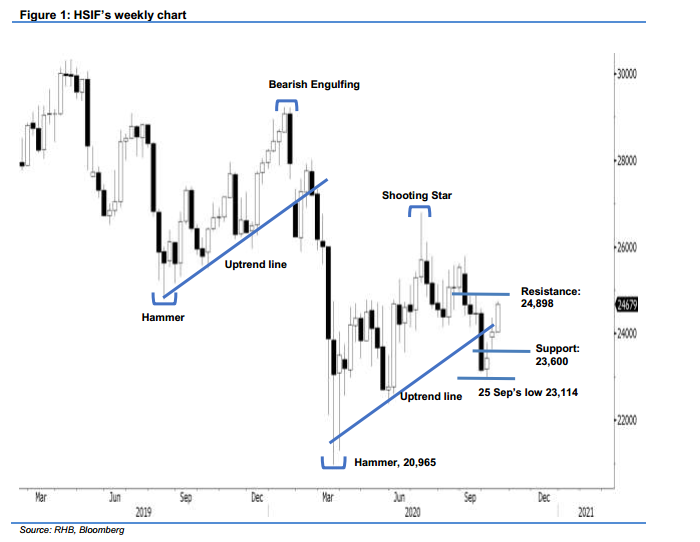

Hang Seng Index Futures - Uptrend Still Alive

rhboskres

Publish date: Wed, 14 Oct 2020, 04:54 PM

Maintain long positions. The HSIF weekly candle is back on track on the uptrend line, which began during the week of 20 Mar, or the low of 20965 pts. For the uptrend line to stay intact, the index should not break the support level, whereby the support zone is between 23,600 and 23,880 pts. We observe that the previous selldown started with a bearish engulfing weekly candle and shooting star. So far, we have yet to spot any bearish reversal weekly candles. Hence we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these positions at 23,951 pts, during the week ended 9 Oct. For risk-management purposes, we raise the stop-loss level to 23,880 pts.

The immediate support level is set at 23,880 pts, followed by the 23,600-pt mark. On the upside, the immediate resistance will be at 24,898 pts, and followed by the 25,000-pt round figure.

Source: RHB Securities Research - 14 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024