WTI Crude - Moving Up Trailing-Stop

rhboskres

Publish date: Thu, 15 Oct 2020, 04:37 PM

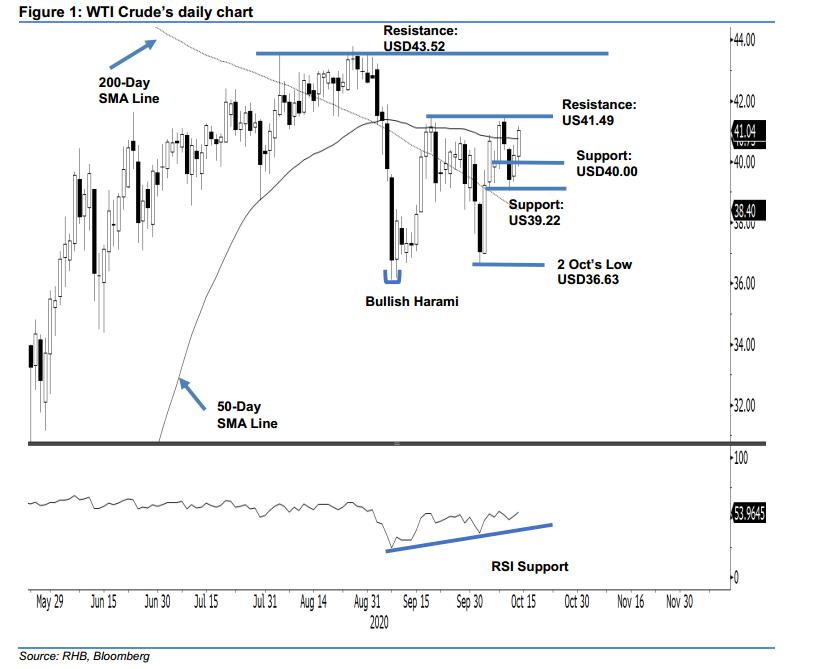

Maintain long positions. The WTI Crude advanced USD0.84 to settle at USD41.04 – re-crossing slightly above the 200-day SMA line. The latest two sessions’ positive performance has almost completely erased the sharp drops registered on 9 and 12 Oct – indicating the lengthy multi-week counter-trend rebound that started from 9 Sep’s “Bullish Harami” formation is still valid. Towards the upside, we are expecting the USD41.49 resistance to be tested or crossed, before we look for possible price reversal signals to mark the beginning of the next leg of retracement phase. For now, we are keeping our positive trading bias.

With no price exhaustion signal spotted, we recommend traders stay in long positions. We initiated these at USD39.22, or the closing level of 5 Oct. To manage risks, a stop-loss can be placed below USD40.00.

The immediate support is revised to the USD40.00 round figure, followed by USD39.22. On the other hand, the immediate resistance is now eyed at 18 Sep’s high of USD41.49, followed by USD42.00.

Source: RHB Securities Research - 15 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024