COMEX Gold: the Bulls Take a Breather Near USD1900

rhboskres

Publish date: Mon, 19 Oct 2020, 11:12 AM

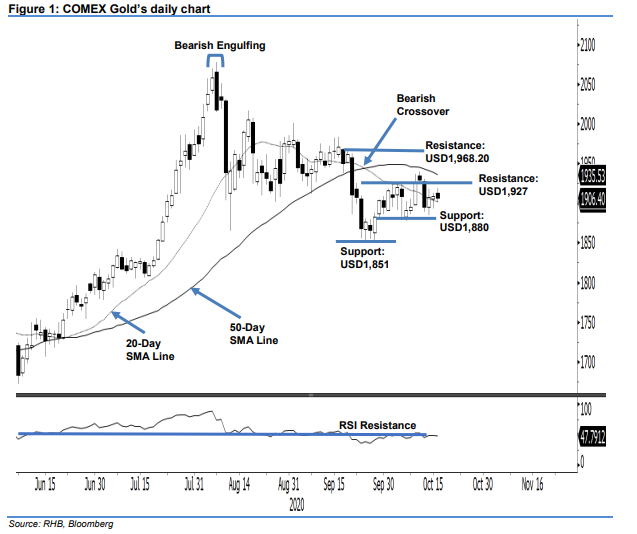

Maintain long positions. The COMEX Gold continued its consolidation near the USD1,900 mark, losing USD2.50 to close at USD1,906.4. The precious metal started the session USD3.80 higher at USD1,912.70 and fell to the session’s low of USD1,901.10, before rebounding USD17.60 towards the USD1,918.70 high. As the momentum indicator RSI fell below the 50% threshold level, we expect more sideways consolidation near the USD1,900 support level. The index needs to breach the immediate resistance level to resume its uptrend move. With the higher lows – which started from the USD1,851 level – remaining intact, we maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these positions at USD1,903.20, or the closing level of 29 Sep. For risk-management purposes, a stop-loss is set at the USD1,880 mark.

The immediate support level is marked at USD1,880, or the low of 29 Sep. This is followed by USD1,851, which was 28 Sep’s low. Meanwhile, the immediate resistance is maintained at the USD1,927 threshold, and followed by USD1,968.20, or the high of 18 Sep.

Source: RHB Securities Research - 19 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024