Hang Seng Index Futures: Still Bound by Resistance

rhboskres

Publish date: Tue, 20 Oct 2020, 11:24 AM

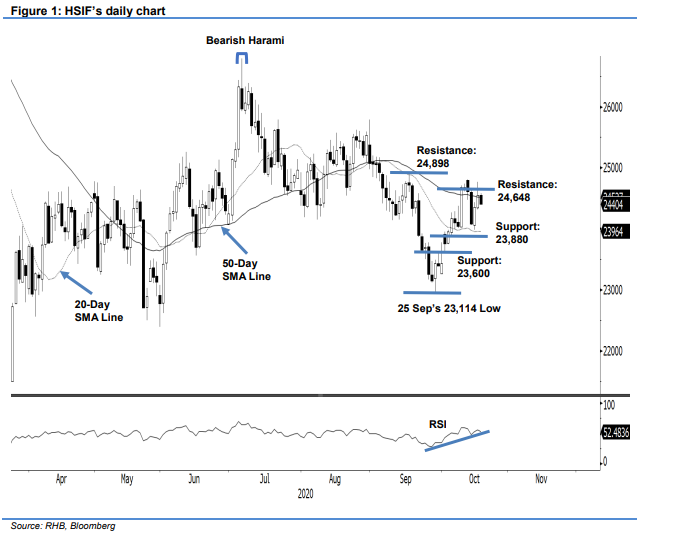

Maintain long positions. The HSIF briefly touched the 24,648-pt resistance yesterday, but failed to establish a foothold and closed lower. The index started with optimism, gapping up 145 pts to 24,500 pts before moving towards the session’s 24,766-pt high. It then slid 341 pts to reach a session low of 24,425 pts before recovering higher to close flat at 24,549 pts. During the night session, the HSIF inched higher at 24,556 pts and travelled towards the session’s high of 24,582 pts. However, the bullish energy faltered, and the index fell 178 pts to close at the session low of 24,404 pts. So far, the HSIF’s price formation is still maintaining a bullish posture of higher lows. Admist the RSI trending above 50%, we are expecting the bullish momentum to pick up should the index cross the resistance near 50-day SMA line during the coming session. Premised on this, we maintain our positive trading bias.

We recommend traders stick to long positions. We initiated these at 23,951 pts, or the closing level of 6 Oct. For riskmanagement purposes, the stop-loss is marked at 23,880 pts, or the day low on 7 Oct.

The immediate support level remains unchanged at 23,880 pts, and is followed by the 23,600-pt mark. On the upside, the immediate resistance is sighted at 15 Oct’s day high of 24,648 pts and followed by the 24,898-pt mark.

Source: RHB Securities Research - 20 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024