COMEX Gold: Continued Consolidation Near USD1,900

rhboskres

Publish date: Tue, 20 Oct 2020, 11:25 AM

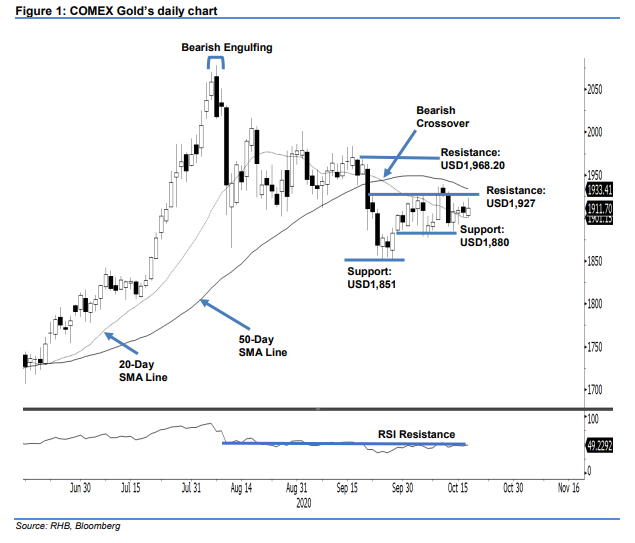

Maintain long positions. The COMEX Gold extended its consolidation near the USD1,900 mark, gaining USD5.30 to close at USD1,911.70. The precious metal started the session USD3.20 lower at USD1,903.20, and dipped to the session’s low of USD1,900.20. However, the momentum picked up and it rebounded USD23.20 towards the USD1,923.40 high. With the indicator RSI falling short of the 50% threshold level, we think the COMEX Gold will continue moving sideways and bounce within a tight USD47.00 range, ie the band between the high of USD1,927 and low of USD1,880. A breakout of the either boundary should see the end of the consolidation. Meanwhile, we maintain our positive trading bias.

We recommend traders stick to long positions. We initiated these positions at USD1,903.20, or the closing level of 29 Sep. For risk-management purposes, a stop-loss can be set at the USD1,880 mark.

The immediate support level is marked at USD1,880 and followed by USD1,851, which was 28 Sep’s low. Meanwhile, the immediate resistance is sighted at USD1,927 and followed by USD1,968.20, or the high of 18 Sep.

Source: RHB Securities Research - 20 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024