FKLI - Moving Down The Trailling - Stop

rhboskres

Publish date: Wed, 21 Oct 2020, 04:47 PM

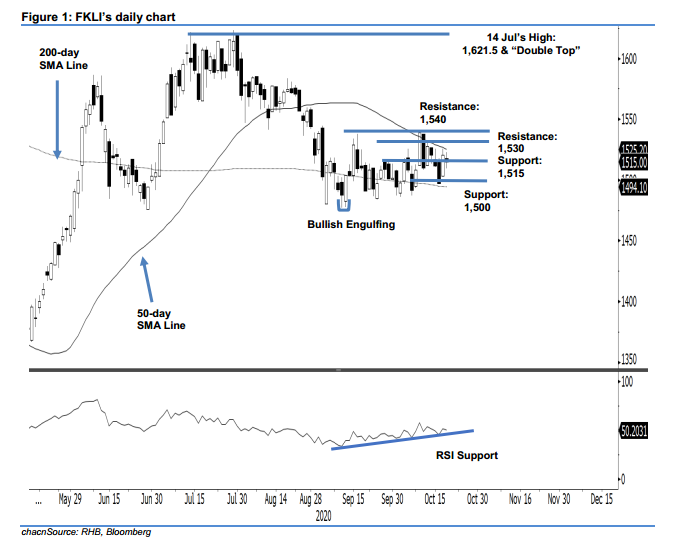

Maintain short positons. The FKLI shed 5.5 pts to close at the 1,515-pt immediate support. The negative session came after a sharp rebound in the prior session from an area near the 200-day SMA line. The lack of positive followthrough and the fact the index is still capped by the 50-day SMA line indicate that the prospects of a deeper rebound to develop are still low at this juncture. Towards the upside, a rebound extension can be signalled should the index manage to breach 1,530 pts – a price point located slightly above the 50-day SMA line. For now, we are keeping our negative trading bias.

We recommend that traders stick to short positons. We initiated these at 1,510 pts, the closing level of 12 Oct. To manage risks, a stop-loss can now be placed above 1,530 pts.

The immediate support is maintained at 1,515 pts, followed by the round figure of 1,500 pts. Meanwhile, the immediate resistance levels are 1,530 pts and 1,540 pts.

Source: RHB Securities Research - 21 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024