WTI Crude - Testing the Immediate Resistance

rhboskres

Publish date: Wed, 21 Oct 2020, 05:07 PM

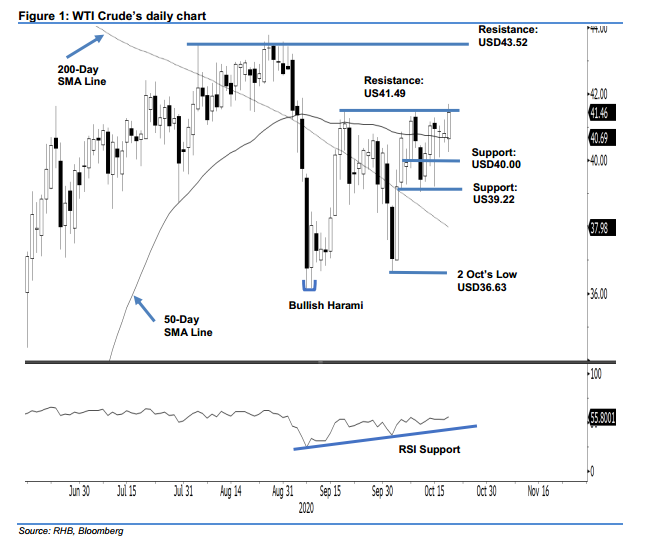

Maintain long positions. The WTI Crude met our minimum expectations, ie re-testing the USD41.49 immediate resistance. The latest session saw the commodity swinging to a USD41.70 high before closing USD0.63 higher at USD41.46. While it failed to close above said immediate resistance, we are not seeing definitive price rejection signals either to signal an end to what we see as a possible multi-week counter-trend rebound, which started from 9 Sep’s “Bullish Harami” formation. Hence, we are keeping to our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD39.22, or the closing level of 5 Oct. To manage risks, a stop-loss can be placed below the USD40.00 mark.

We are keeping our support levels at the USD40.00 round figure, which is followed by the USD39.22 mark. Meanwhile, the immediate resistance is set at 18 Sep’s high of USD41.49 and followed by the USD42.00 level.

Source: RHB Securities Research - 21 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024